This article discusses a short synopsis of the Made in China 2025 Plan, a detailed trading strategy for Nordson (free), and a detailed investment thesis on the company. Be sure to upgrade your subscription as future publications may have this information behind the paywall.

Will the US ever be dethroned as the economic powerhouse? Who will take the king and sit at the iron throne?

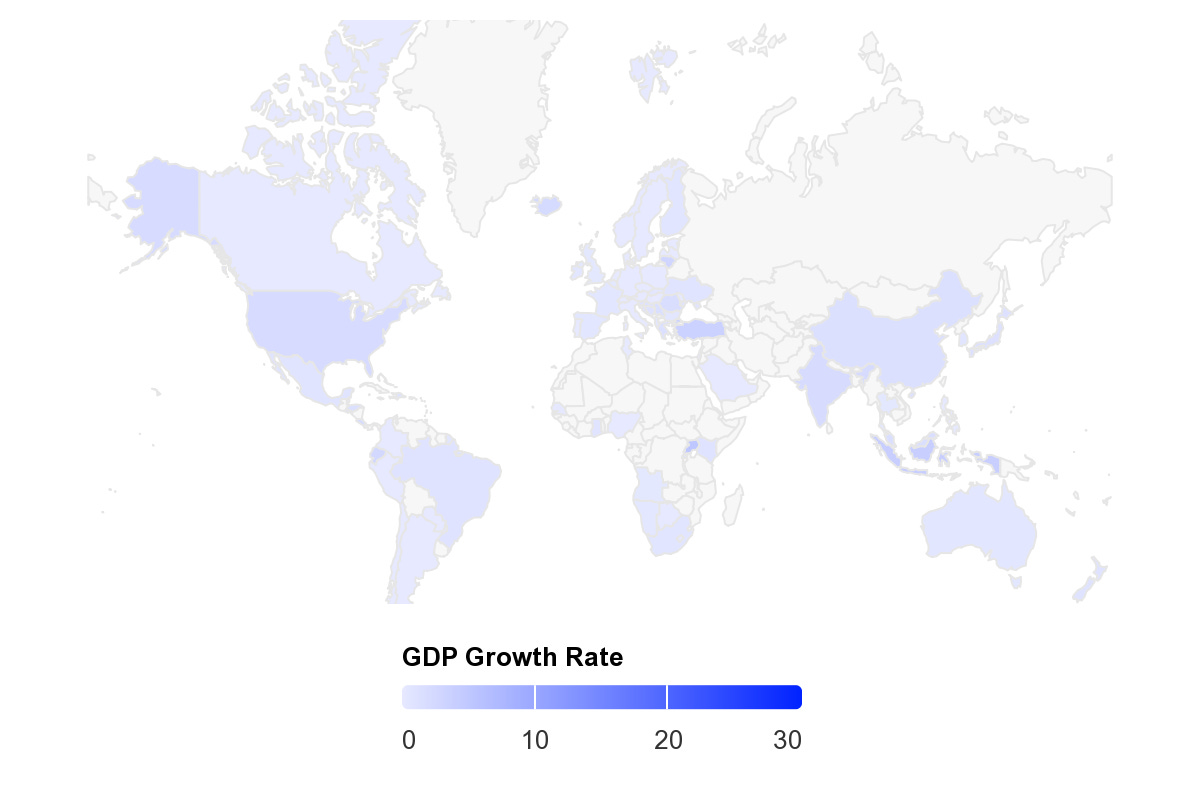

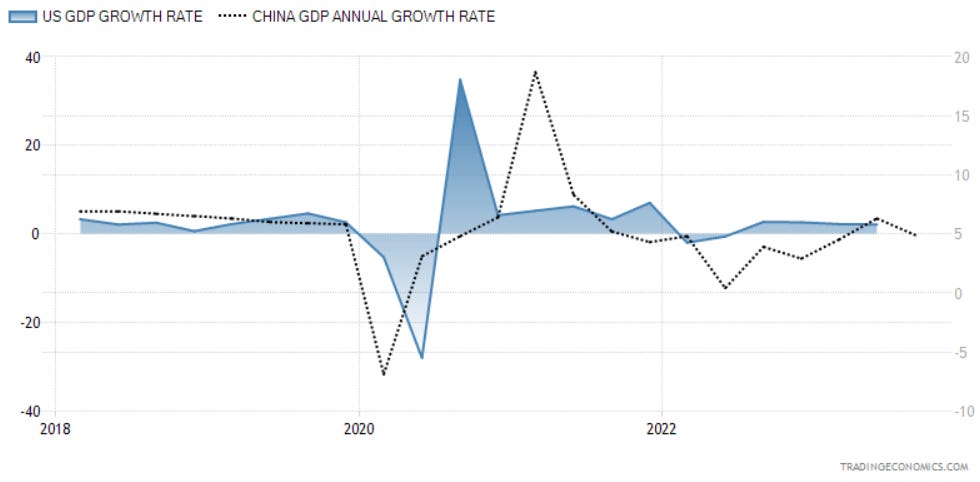

Will China ever catch up? Considering their exceptional growth rate, it is very plausible. China’s GDP is expected to grow at a rate of 5% for 2023, well above the IMF’s projection of 2.1% in the US.

China has experienced incredible GDP growth since the 90s as the Country industrialized and enacted a mass population migration from farms to cities. This trend drew significant interest as companies and investors sought to relocate or add additional operations to China and flood the market with new investment capital. The real estate industry had been redlining for years as the CCP sought growth at all costs. In total, the real estate industry in China accounted for around 25% of total GDP. Having the pedal to the metal has absolutely bit China in the butt as the real estate industry switched from the red line to marking in red ink. As the national giants fell one by one led by China Garden taking the spotlight with missed bond payments from Evergrande, GDP growth has certainly been under pressure.

On top of that, unemployment has been on the rise behind the iron curtain. In total, China’s unemployment rate remains at 5% with youth unemployment at an elevated 21.3% (since last reported in June). This figure has been a defining point for many news cycles as investors attempted to gauge the health of a foreign country. Maybe China’s culture is different from ours with their working population as the age range for youth unemployment in each country is between the ages of 16 – 24. The US has an 8.4% youth unemployment rate as of September 2023. Sure, China’s rate is nearly 3x higher than the in the US; however, is this figure really significant? I mean, I was mowing lawns for $25 apiece making $75-100/week. Technically I was unemployed.

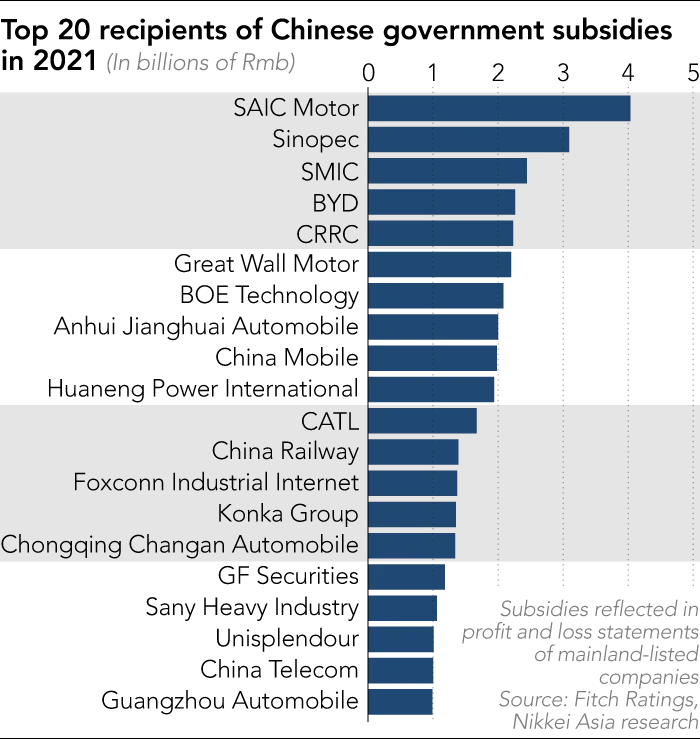

Back in 2015, Chinese President Xi enacted a 10-year plan dubbed Made in China 2025 Plan that essentially added fuel to the industrial revolution flame. China 2025 was designed after Germany’s Industry 4.0 in which the plan laid out the top development priorities for industry innovation. This plan outlined its top 10 priorities in order to advance Chinese economic development. These priorities included advancing information technology, automation and robotics, aerospace equipment, maritime vessels & equipment, advanced rail equipment, next generation energy-fueled vehicles, power transmission, agriculture, materials, and pharmaceuticals and advanced medical devices. One of the key differences between China’s and Germany’s plans was the robust use of subsidies.

China set in full throttle subsidies and tax credits for companies that fit within their criteria.

This essentially set the economy into growth hyperdrive, like a bull running at full speed at the fighter (not at all a simile to China vs. the US). One of the biggest challenges, and I believe Trump saw this when imposing his trade war with China, was that China didn’t just seek to become an industrial powerhouse, but they sought to eliminate the necessity of imports, thereby eliminating foreign participation and competition.

What made this policy so dangerous to the US economy is how much growth and advancement Chinese industry has taken on with the utilization of subsidies. Similar to Japan’s tactic in dumping steel onto the open market post-industrialization after WWII, Chinese firms are able to undercut foreign competition with lower prices as a result of low cost production and subsidies. You can read on this in my article American Steel: The Metal Gods of the Steel Industry

As the report Made in China 2025 and the Future of American Industry by this committee states: “If MIC2025 is successful . . . what the ‘China shock’ did to domestic U.S. production of electronics, furniture, plastics, metals, and vehicle parts could threaten to repeat itself in capital goods like machinery, automobiles, high-end computers, rail, and aerospace products.

– Bonnie S. Glaser, Made in China 2025 and the Future of American Industry

Though these challenges aren’t blatantly visible, they certainly are bellying up sparsely. The company we will review today is Nordson Corporation (NASDAQ: NDSN). Nordson primarily designs and manufactures dispensers and packaging for industrial and medical fluids and adhesives. Exposure to China is relatively high with 13% of long-lived assets and 33% of revenue residing and deriving from APAC, primarily in China.

Though this exposure is stymied by the US, it still remains a significant needle-moving position that can challenge the firm’s sustainable growth trajectory.

Nordson Corp. is valued at $13b by market capitalization with roughly $1.5b in net debt for an enterprise value of $14.5b (the report below uses historical figures net of the recently issued $850mm debt issuance).

In my report, I will outline some of the challenges Nordson faces in their electronics and medical device segments. Though management anticipates these cyclical trends to remediate throughout 2024, the impact of China insourcing may lead to a more secular effect. Be sure to upgrade your subscription for the full detailed report on Nordson!

Trading Strategy

Nordson, with the inclusion of the $850mm debt issuance, trades at 18x EV/EBITDA, a significant premium over its competitors on a SOTP basis. Competitors would suggest this stock should be valued closer to 15.69x, an 8% decline in price. Though this isn’t a gangbuster of a drop, this is only a projection out using FY23 estimates (one quarter out). I believe the near-term challenges Nordson faces throughout 2024 will create a selling opportunity for those that can short stocks.

Stepping away from the fundamentals and into the technical, on a long-term Elliot Wave basis, NDSN has completed a very, very long-term 3-wave upcycle and is positioned for a significant drop in price. Given the flat/sideways movement since 2022, wave theory would suggest that this stock is positioned for downward pressure. Considering the 14-day RSI of 41, NDSN is slightly oversold and can continue bouncing around in this range until a catalytical event, such as their upcoming q4’23 earnings call. Though I don’t see an extraordinary move on the top line, the company seems to be struggling with growth and is beginning to take on measures I wouldn’t recommend in this market. Nordson has doubled its debt to acquire ARAG to add an additional $20-30mm in revenue for FY23. This is potentially setting the firm up for a harsh reality as their aggregate interest rate expense increased by 25bps to 5.50%. This will lead to margin compression and potentially a more challenging growth environment.

On a technical basis, this can place the stock closer to $150/share, a -31% slide from today’s price. This price may not be realized for some time as I expect earnings deterioration to be a slow burn. This could possibly materialize as soon as 2h24 depending on the global macro trends. I’ll be updating this regularly as events progress.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.