Going forward, I will be gradually migrating to the new nameplate: Monte Independent Investment Research. For the sake of familiarity, I will maintain the current branding and make any updates when appropriate. Starting next week, this newsletter’s name will change to Monte Investment’s Model Portfolio.

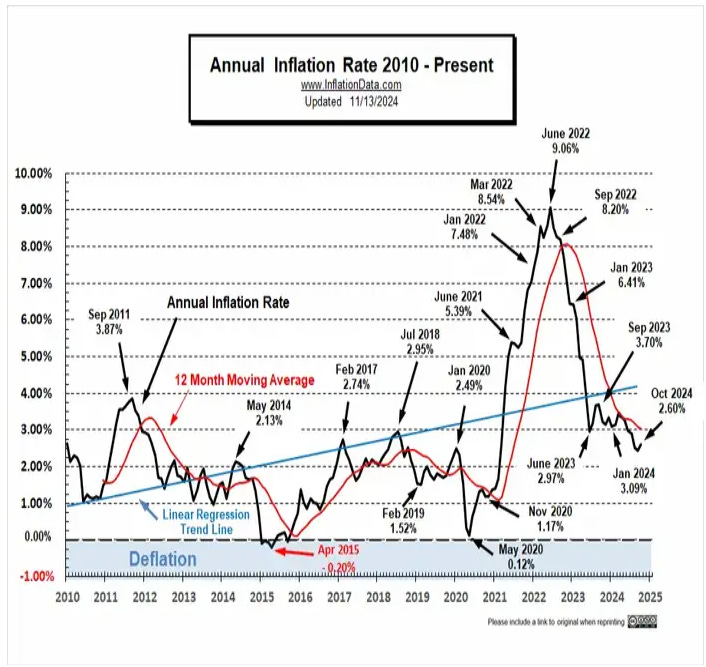

Does anyone have a growing distrust for reported economic data? It is as if the Fed will publish GDP and CPI growth rates while suggesting that growth is strong and that inflation has been beaten down. Sure, the rate of inflation has slowed from its heightened level as seen in 2022; however, this does not necessarily mean that prices have nor will come down to relieve consumers of the high cost of living.

Talk to just about any professional in the industry and they’ll give you the same boilerplate statement: “Inflation is coming down; therefore, the Fed will cut rates.”

Apollo Global Management co-president, Scott Kleinman, warned that inflation is not tamed.

The Fed can say what it wants. You just have to open your eyes and look around.

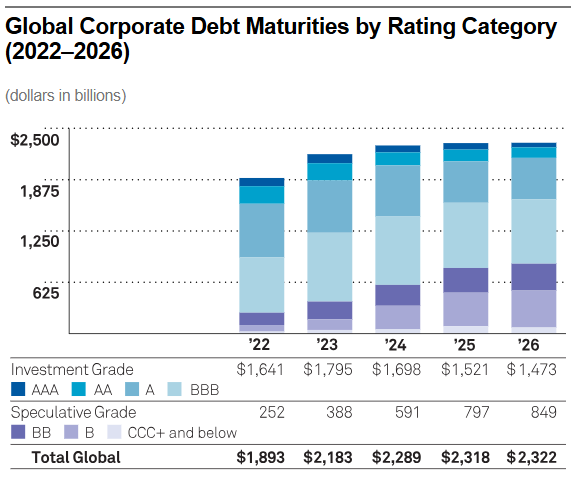

I’m telling you now that inflation is absolutely not the reason the Fed is cutting interest rates. It’s a cop-out. I stand by my statement relating to CRE debt coming due in 2025-2026 and the need to refi at a more appealing rate.

On the corporate debt side, a larger proportion of high-yield bonds will be maturing throughout the next few years, with 34% of the total maturities in 2025 being below investment grade. When excluding financial debt, speculative makes up 51% in the US in terms of debt maturing in 2025. The concentration of below IG debt only grows from there, creating certain challenges for these riskier assets.

Looking to inflation, the Producer Price Index [PPI] took a turn higher for the month of October, increasing at an aggregate 3.5% rate when excluding energy & food. Energy prices eased by -8.6% when compared to the previous year. Food continued its upward route at 2.7% year-over-year growth.

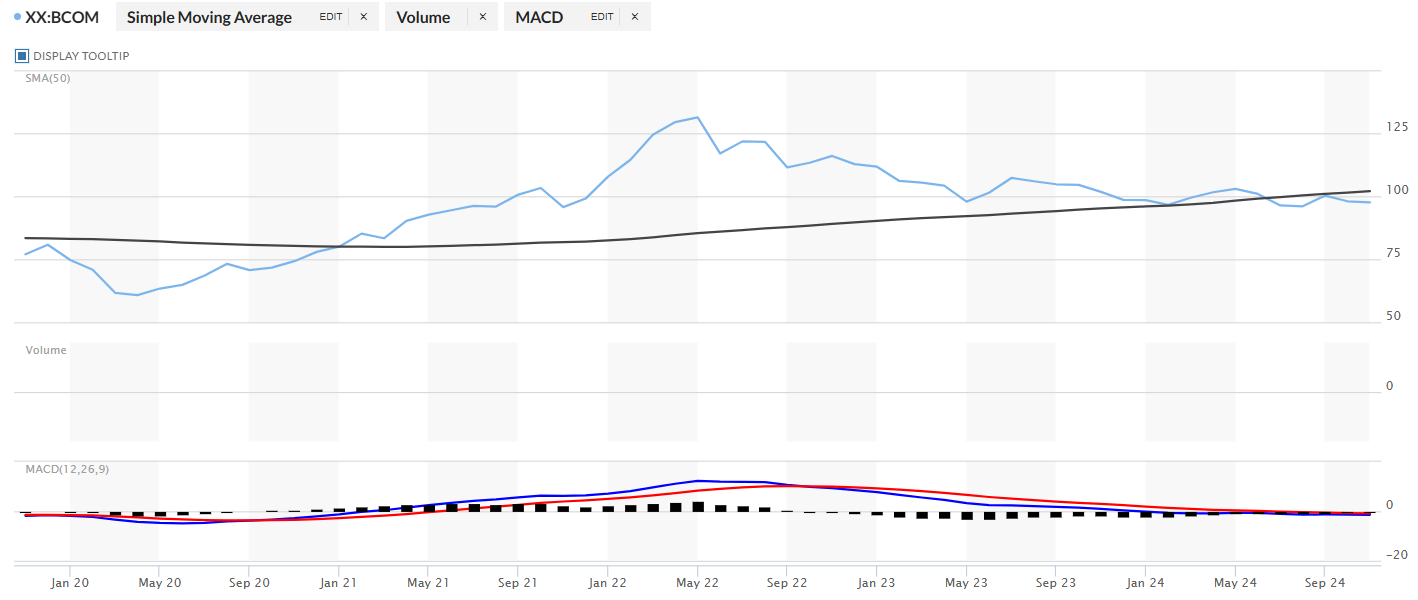

As it relates to the PPI, the Bloomberg Commodity Index [BCOM] remains relatively elevated when compared to the pre-C19 environment with no real signs of decline. This will likely continue to pressure producers as prices remain high, resulting in either producers or consumers left to absorb the costs.

I know I have referenced this before, but if anyone remembers their Econ 101 lesson covering Austrian Economics, the need for a major reset of the production function will be necessary if prices are to ever decline. This means more investments for new mining operations to extract high-demand metals, such as copper, to support price moderation.

Looking to housing, the National Association of Home Builders [NAHB] Housing Market Index printed a stronger-than-expected report at 46%, up from an estimated 44%.

October Retail Sales expanded by 2.8%, suggesting that the consumer remains resilient in terms of spending. There are some interesting factors relating to this that would suggest otherwise coming directly from one of the largest retailers; but what do they know.

Management at Amazon (AMZN) has suggested for the last few quarters that consumers are more heavily rotating out of premium brands and into Amazon’s budget-friendly private label brands while purchasing at higher volumes. Though this isn’t necessarily a bad thing for Amazon, it may suggest that the dollar is being spread thinner and thinner as lower-cost items are favored over the more appealing, branded items.

Referencing my distrust as suggested at the top, it’s clear that inflationary pressures remain strenuous for consumers. No matter how many times the talking heads on CNBC or Bloomberg would suggest otherwise, speaking in broad strokes that inflation is easing is out of touch. It’s as if these news anchors and data reports don’t drive, or go to the grocery store, or peruse Zillow or Redfin.

The coming two weeks will be bringing us to the close of the earnings cycle with Nvidia (NVDA) reporting on Wednesday, and the majority of infrastructure tech names the following week. I’ll be providing updates on each of the covered firms during this reporting period.

Let’s review some company updates

Plains All American (NASDAQ: PAA)

Plains All American Pipeline Aims For Fee-Based Growth

Plains All American is diversifying the organization into more fee-based revenue streams. The firm has traditionally focused its efforts in the Permian Basin for transporting crude from the basin to the Gulf Coast for processing or export. Plains All American is expanding its operational footprint in Canada, primarily in the Alberta area as more oil & gas producers explore and exploit the region’s resources. As part of this expansion, Plains All American is putting more attention into NGL fractionation with a fee-based approach in the region, increasing its exposure to a steadier, fixed-rate tariff as opposed to margin, or the difference between buying and selling crude from one end of the pipeline to the other.

Management guided to the top end of its eFY24 range to close out the year, providing significant upside potential to unitholders going forward. PAA units pay out at a 7.34% yield at their current price level.

Despite the optimistic outlook, Plains All American is working in a bear oil market and has no gas exposure. If I were deciding which midstream operator to invest in with limited funds to diversify with, I’d focus on the natural gas and NGL heavy operators, such as Enterprise Products (EPD), ONEOK (OKE), and Kinder Morgan (KMI). The last two are optimal for those seeking C-Corp investing. EPD would be appropriate if you’re seeking the MLP structure.

CyberArk Software (NASDAQ: CYBR)

CyberArk Will Benefit From The AI Identity Crisis

CyberArk primarily focuses on identity-related cybersecurity software. The firm may be well-positioned for growth going forward as more enterprises migrate more workloads into the cloud and increase AI application exposure. One of the biggest AI-related risks that CyberArk is addressing is machine identity management. As Blade Runner themed as this sounds, accounting for and securing one’s AI agents is potentially one of the most critical exercises that needs to be flexed in a time of higher caliber applications.

Identity management has historically been a very IT administrative task of managing and auditing a company’s Active Directory to ensure profiles are created and removed and ensuring that the appropriate personnel have the appropriate permissions. Today’s operations are quickly becoming much more complex as the machine-to-human ratio expands at a rapid pace.

Not only does CyberArk track these features, but the firm automates the process, allowing users to match this level of scaling to ensure no workload goes unchecked.

Amazon.com (NASDAQ: AMZN)

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.