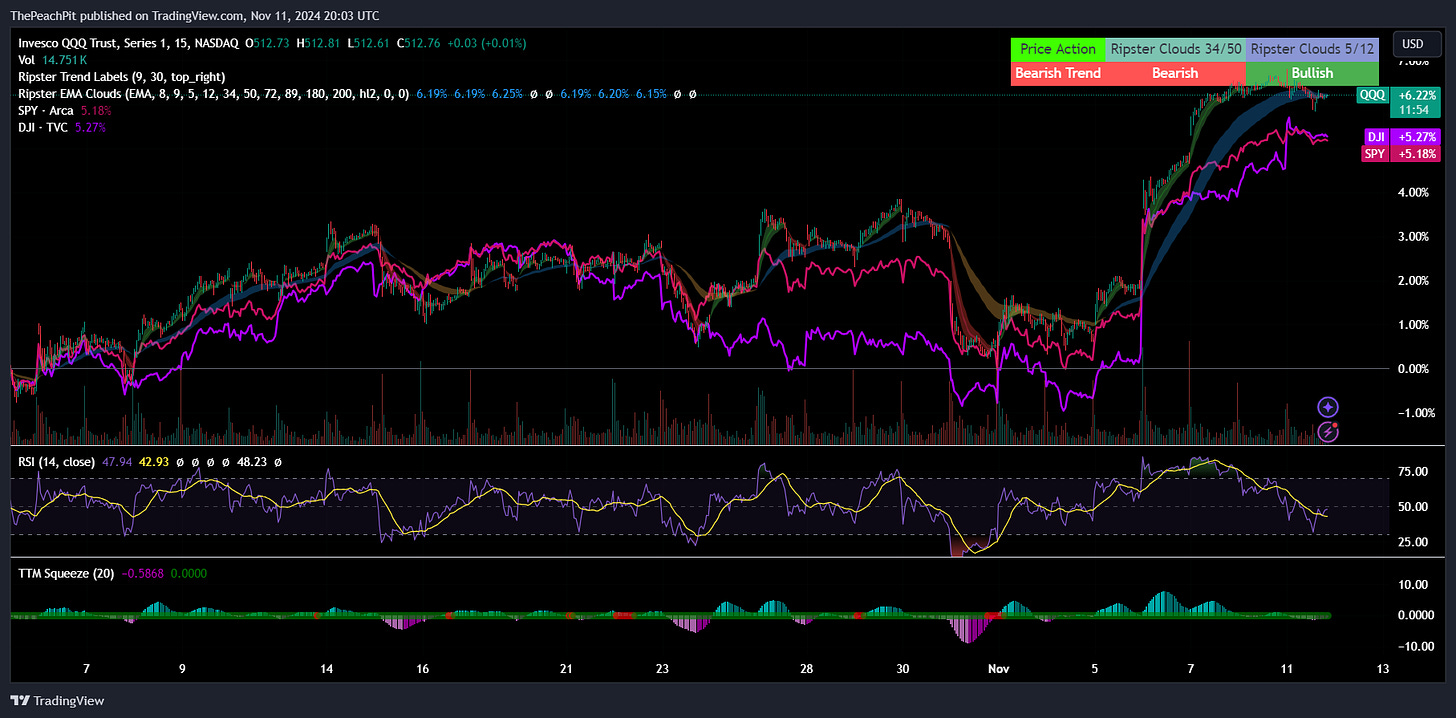

We’re off to a euphoric week for stocks and cryptocurrencies, once the market realized its best post-election return.

Bitcoin is also driving significant strength as the new administration has been exceptionally vocal in supporting cryptocurrency, suggesting that the US needs a strategic bitcoin reserve. Bitcoin is up 25% post-election.

Last week, Fed Chairman Jerome Powell cut rates by 25bps, resulting in a Federal Funds Rate in the range of 4.50-4.75%. What’s interesting is how this is affecting the yield curve. The curve is gradually turning flat-to-steepening as the gap between the 10-year and 3-month treasuries narrows. A positive flip of these two durations can signal stronger confidence in the broader market. What isn’t good for the market is the steepening as a result of a higher 10-year as opposed to a declining 3-month. Despite debt issuances theoretically being cheaper now when compared to just a few months ago, fixed rates aren’t necessarily adjusting to the declining SOFR rate.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.