Today is the day everyone has been waiting for. The last two weeks running up to election day have felt like an eternity. I’m personally just ready for my newsfeed to move away from politics and go back to showing all investment-related news.

Let’s review a few of the economic data points that came out last week before turning to trading ideas.

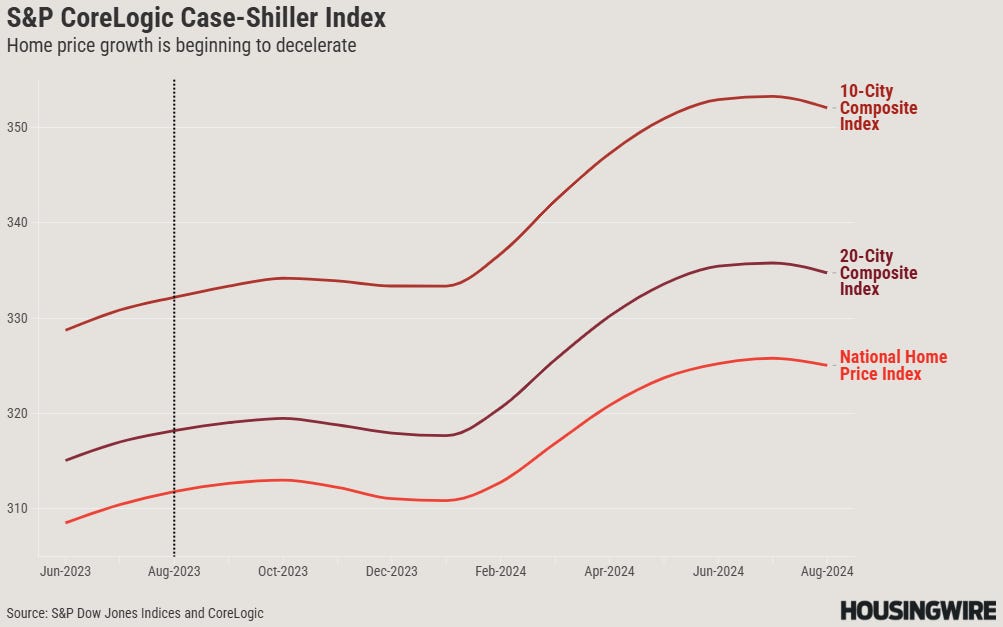

The S&P CoreLogic Case-Shiller Index provided some interesting insight into the current state of the housing market. Though it may be too soon to connect the dots, housing prices grew at a diminishing rate despite the mortgage rate drop from 7% to 6.35%. I’m not expecting this to be the beginning of any significant price moves down. The slowing growth paired with easement of rates may be signaling to the market that prices are coming close to their peak.

Turning our attention to the broader aggregate, GDP, US GDP increased at a 2.8% annualized rate in q3’24, 30bps shy of the 3.1% estimate going into the print. GDP growth was primarily driven by consumer and government spending, driving the budget deficit to over $1.8T in FY24. Accordingly, government spending was driven by a 14.9% increase in defense spending.

Consumer spending continues to be impacted by inflation. PCE printed 2.1% for September 2024, 2.7% when excluding food and energy. Spending on health care, housing, and utilities continues to impact consumers’ discretionary income with prescription medication prices leading the charge. Food and beverage also remains impactful to the consumers’ budgets.

Speaking of food & beverage, the Wall Street Journal reported on Monday that TGI Fridays filed for bankruptcy after multiple years of declining operations coming out of C19. According to another report from The Journal coming out on October 21, 2024:

Restaurant chains and operators this year are on track to declare the most bankruptcies in decades outside of 2020.

With smaller tickets, less frequent visits, and fewer regulars attending their favorite watering holes, I find it hard to believe that the economy is at peak performance.

On the one hand, you see aggregate economic data presenting rosy outlooks. On the other hand, actually going out and experiencing the decline firsthand tells a much more dismal story. Though I’m not one to regularly eat out, especially at chain restaurants, I will say that the few places I have frequented over the years are certainly emptier than they ever had been. The few concerts I have attended in the last year have a lower turnout than shows a few years back. When’s the last time you went to a Ruth’s Chris or Capital Grille for lunch?

Friday’s NFP print came in worse than expected, adding 12,000 jobs for the month of October. Consensus estimates called for 113,000 while TradingEconomics called for 180,000. To no surprise, the August and September prints were both revised down by a combined 112,000.

Lastly, the S&P Global PMI reading provided another contractionary month in October. The report indicated that global production is falling with the eurozone experiencing the steepest decline. This shouldn’t come to much of a surprise as the European automotive industry has been curtailing production and pulling out of battery-related projects.

Looking ahead to the current week, Tuesday will provide the ISM-PMI readings, Wednesday the MBA Mortgage update, Thursday retail inventories and the Fed’s interest rate decision, and Friday the Michigan consumer sentiment index.

Let’s take a look at my updated company guidance

Palantir (NYSE: PLTR)

Palantir Is Positioned For A Beat And Raise In Its Upcoming Earnings

I had published a pre-earnings release on PLTR on October 30, 2024. The company reported a strong earnings beat of $725mm in revenue and a diluted EPS of $0.10/share, beating consensus estimates by $21.83mm and $0.01/share, respectively. My revenue estimate was just shy of $5mm.

Outside of the earnings beat, the company has many positive catalysts in the fire. 1. Being added to the S&P 500. This adds a new shareholder base and will take up a portion of the real estate of the float. 2. AI investments continue to push higher. The hyperscalers continue to invest tens-of-billions-of-dollars into building out GPU capacity. This means that enterprises are investing in AI-related applications that are housed on the hyperscalers GPUs. Put 1 & 1 together and you can figure that equation out.

Phunware (NASDAQ: PHUN)

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.