Zebra Technologies (NASDAQ: ZBRA) has made its rounds in my screeners over the years and I never gave the company much thought. In my mind, Zebra was a barcode company without much pizazz.

Revisiting the company this time around brings forth much more appeal given the shift in how technology is being used at the workplace with the emergence of AI. Though AI seems to be this year’s buzzword 3 years running, the theme remains structurally sound, albeit misunderstood.

Zebra has multiple catalysts at hand that can drive growth:

Industry 4.0

Retail optimization

With recent headlines suggesting a lower capital outlay for compute capacity relating to AI and tariffs redrawing international trade, ZBRA shares have faced significant selling pressure, pushing shares from a recent high of $420/share down to their current level of $285/share. Though selling may continue as the market finds new grounding, I suspect much of the noise in the headlines is just that, noise, and that the market will correct from this decline.

Though much of Jensen Huang’s presentation at the Nvidia GTC 2025 conference may have been talking up its book, the key takeaways would be that infrastructure is significantly under-deployed and that enterprises have only scratched the surface in AI inferencing. One of the biggest takeaways from the GTC conference was one that we had already suspected: Industry 4.0. A.K.A. AI-enabled robotics. With more manufacturing expected to migrate to the US, robotics will be more heavily relied upon to augment the workforce, mostly because we don’t have the skilled labor for such tasks. This was a major concern raised by Taiwan Semiconductor (TSMC) about a year or so ago when planning its Arizona foundries.

Besides, Gartner, the technology research firm, suggested in its 2025 IT spending forecast that departments will just now begin to leverage AI in the workplace.

What’s just as interesting is the growing frequency of AI skills being required in job applications. Though still a relatively small percentage, it is growing at a rapid clip. The ability to work the same tasks faster and more efficiently will be valuable in the next-generation workforce.

AI has been said to be the next technology revolution following the personal computer. Though it was well before my time in the labor force, PCs eliminated secretaries and typists. AI will have the same impact to the labor force once in full effect; just this time, the reach will broaden out to the physical world. I’ve discussed the importance of AI as it relates to automating enterprise workflows. I discussed in last week’s report covering Teradyne (NASDAQ: TER) that robotics will take charge in the manufacturing environment. And, as Mr. Huang inferred in his keynote, robotics integrated with AI and the omniverse will have a broader reach in their capabilities. Literally, we very well could be living in a world depicted by the Will Smith film iRobot within our lifetimes.

So, how does Zebra fit in?

Zebra brings together an assortment of devices used in the manufacturing and warehouse facilities, as well as retail stores that provide accessibility to “machine vision,” merging the physical and virtual worlds into an autonomous operation. Though much of Zebra’s technology catalog includes sensors, scanners, and handheld devices, the firm also develops mobile robots for warehouses and manufacturing facilities. Though these aren’t the sexy humanoid robots showcased at the Tesla Robotaxi Day, these machines are just as vital to enabling efficiency across the physical realm.

Much of Zebra’s market is utilized for inventory management and store optimization for retailers. Zebra’s technology can essentially allow for retailers to reduce inventory shrink, or spoilage and theft, either of which can significantly impact an already low-margin business. Zebra is also working to embed AI into its IoT products, further enhancing their capabilities for retail customers.

At the end of FY24, Zebra announced its intent to acquire Photoneo, a robotics company that specializes in 3D machine vision solutions, the software that enables industrial robots to execute tasks.

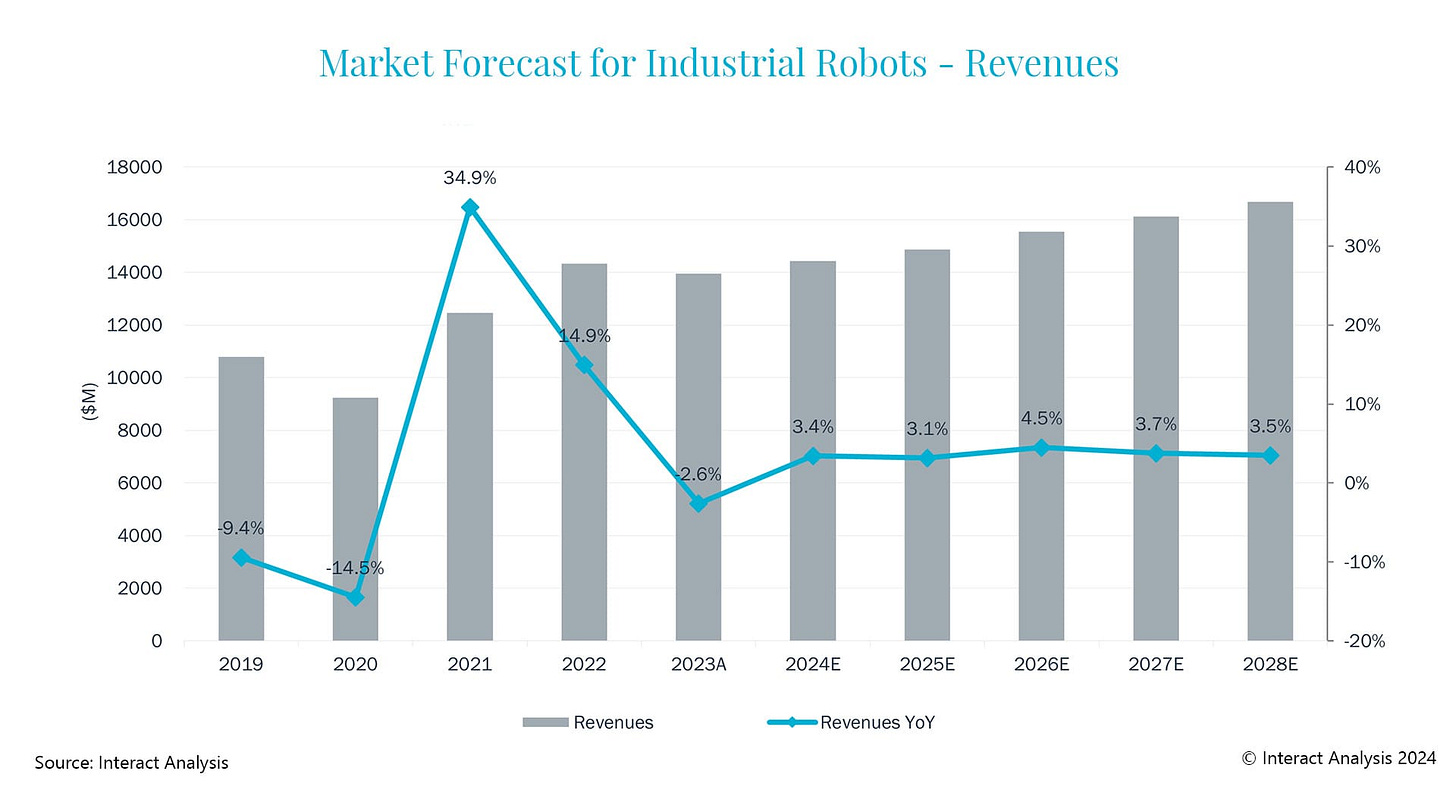

As seen across the industrial technology industry, Zebra faced some growth headwinds in FY23 with a modest recovery in FY24.

Much of the downturn was driven by significant growth in popularity of industrial robotics following the C19 workforce distancing. This led to a significant growth spurt in purchasing in 2021-2022, resulting in a decline in growth in 2023 as inventory churned in the workplace.

Nonetheless, the market has turned to a recovery throughout 2024, as seen in Zebra’s revenue growth.

Breaking out Zebra’s product offerings:

Mobile computers, Tablets & accessories

Printers & supplies

Barcode scanners

RFID

Mobile robots, machine vision, and industrial fixed scanners

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.