Research & Analysis: Symbotic Inc. (NASDAQ: SYM)

SYM, AME, FARO: Industry 4.0: Warehouse Automation

On May 6, 2025, Faro Technologies (NASDAQ: FARO) was acquired by AMETEK (NYSE: AME), sending the stock up by nearly +40%. Faro was previously covered on the Substack on April 11, 2025, prior to q1’25 earnings.

Research & Analysis: Faro Technologies (NASDAQ: FARO)

Given the growth potential in this market, I will be launching an industry-specific portfolio that will cover a broad range of related companies in the space. This strategy will be reserved for premium subscribers.

You can review my coverage of AMETEK here:

Ametek Acquires Robotics Assets With FARO Technologies

In terms of scale, Faro only generated $47mm in aEBITDA in the last twelve months. This compares to AME generating $2.2b. In terms of other acquisitions that may be at hand, Cognex (NASDAQ: CGNX) could be next given its small size.

Symbotic Inc. (NASDAQ: SYM)

This week we will be reviewing Symbotic Inc. (NASDAQ: SYM). Symbotic fits into our Industry 4.0 theme, providing a variety of autonomous systems for supply chains and manufacturing, including machine vision and robotics.

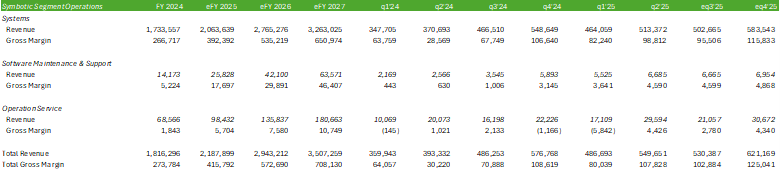

Symbotic operates under three major segments:

Systems

Software Maintenance & Support

Operation Services

The Systems segment primarily entails the design and installation of systems and the software configuration of automation systems. Software Maintenance & Support revenue is generated through long-term contracts for technical support, updates, and upgrades to software licenses. The Operation Services segment is essentially a post-production service provided by Symbotic to help customers optimize and improve operations.

Advanced Systems & Robotics Acquisition: January 28, 2025

Symbotic announced the completion of the acquisition of Walmart’s (WMT) advanced systems and robotics [ASR] business. As part of the acquisition, Symbotic signed a commercial agreement with Walmart to develop and deploy automation systems for accelerated pickup and delivery centers [APDs] at Walmart stores. As part of the acquisition, Symbotic brought in operating services for APD sites.

If the performance criteria are achieved, Walmart is committed to purchasing and deploying systems for 400 APDs for an agreed-upon payment of $520mm, inclusive of the $230mm prepayment by Walmart. Accordingly, the agreement with Walmart has the potential to add $5b+ to Symbotic’s backlog in the $300b micro-fulfillment market.

Subsequent to the close of q2’25, Symbotic entered into a corporate restructuring, reducing the workforce by 320-390 in connection with the ASR acquisition. I wouldn’t hold much weight to this as there is likely significant overlap in personnel between the two firms.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.