Searching for value will take you down all sorts of avenues. The last few months, we focused on industrial automation and robotics names, bringing forth a market that is entering into its long-term growth curve following the 2021 hype-cycle.

Like any industry, there will always be winners and losers. This cohort of companies in particular will display this phenomenon given the diverse industry niches.

Before we get into the report, I want to announce my partnership with Surmount & QuantBase in hosting my model portfolio. You can now directly participate in the strategy that we have been presenting every week for the last 2+ years in this newsletter without having to individually input each trade.

Given the current market environment, I am also adjusting my subscription price for the time being. The 50% off Memorial Day promo still applies.

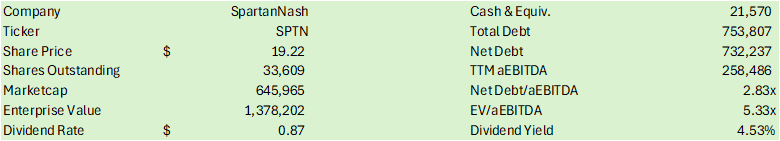

This week’s report will be a beneficiary of the Industry 4.0 movement, retrofitting facilities to improve operational efficiencies. We’ll be walking through SpartanNash Company (NASDAQ: SPTN), a wholesale & retail grocer.

The name came through my channels as being a value + dividend strategy with some appeal in an industry faced with significant inflationary pressures. Though the food & beverage industry doesn’t fall into my typical cohort of companies, I found the company quite interesting given its challenged financial position in what may be a more difficult market to navigate.

SpartanNash participates in both the wholesale and retail markets for grocery distribution as well as its Our Family private label brand.

SpartanNash’s retail outlets are located in what I call the “Deep Midwest,” as what I would define as “cold winters” is drastically exaggerated with double-digit negative temperatures and snow measured in feet rather than inches.

SpartanNash operates roughly 209 locations across 10 states and services 2,300 independent retail locations across all 50 states as well as countries in Europe, Latin America, the Middle East, and Asia. SpartanNash also operates 18 distribution centers covering 8.5mm square feet and internal transportation fleets while leveraging 3rd party shipping partners for global distribution. As of FY24, SpartanNash operated 9 over-the-road tractors, 117 dry vans, and 62 refrigerated trailers through short-term rental contracts.

Retail store footprints range from 11,000-90,000 square feet with an average store size of 42,000 square feet per store.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.