Research & Analysis: Emerson Electric (NYSE: EMR)

Industry 4.0: Industrial automation

As we continue to assess companies that participate in the Industry 4.0 theme, I’m slowly putting together a themed portfolio that should be available within the next few weeks. This strategy will be highly focused on companies that participate in servicing the industrial automation market, whether through software or hardware, as well as related industries such as technology and energy. This portfolio will only be available to premium subscribers to Monte Independent Investment Research and will be reported in tandem with my recommended balanced portfolio.

This week’s single-stock newsletter covers Emerson Electric (NYSE: EMR). Digging through my old research files, this is actually a firm I pitched back in 2021 when I was an analyst at a value shop. At the time, the company had just turned over its executive leadership and had begun its journey towards a swath of acquisitions in automation technology.

EMR shares have certainly experienced their fair share of chop throughout the years with the biggest decline occurring in 2025 following the broad-stroke industry scare for data center demand decline, slower power demand growth, and tariffs. Though the first two points were likely a hiccup in the market due to uncertainty, tariffs should not be considered detrimental for Emerson and the industries the firm participates in.

What the 2025 market correction tells me is that investors are fearful in the short-term and are forgetful of long-term opportunity. In the near-term, these major macro adjustments created significant uncertainty in the market, bringing more unknowns to growth and trade policy than what was almost assured. Prior to the hints of Microsoft adjusting its growth trajectory compute capacity supply, investors were adamant that capital investments would continue at sky-high rates. I have reason to believe this is still the case, but this has yet to be confirmed.

Tariffs have been the talk of the town this quarter, with each CEO being questioned on their respective company’s position and impact to tariffs. Media has added fuel to the flame by circulating tariff risk nearly nonstop.

What I have gotten out of it is that all things are temporary and negotiable. Tariffs, as policy has suggested thus far, are temporary and negotiable. I highly doubt any trade partner will fail to negotiate a deal within the 90-day period that will result in a return of the sky-high rate first presented on Liberation Day. Pain is already making its rounds in China’s economy with some suggesting that China has already eliminated the 125% tariff on certain semiconductors.

The fact of the matter is that Huawei’s latest GPU competes at 60% of the compute capacity of the Nvidia H20, the throttled chip approved for sale to China. The H20 has 28% lower performance when compared to the H100 GPU. The Blackwell B200 has 4x the performance of the H100. If you think for one second China doesn’t need the US, you are highly mistaken or are obsessed with fast fashion.

Anyways, this tariff regime isn’t Emerson’s first rodeo. As we’ll discuss in this report, Emerson has already mitigated nearly all China risk and has limited exposure to tariffs on Canadian and Mexican imports.

Emerson participates in multiple core markets that we have been focusing on at Monte Independent Investment Research:

Industrial Automation

Liquified Natural Gas Technology

Power Generation, Transmission & Distribution

Within the LNG space, Emerson provides a comprehensive portfolio of automated solutions, including control systems, valves, instrumentation, and other services. The firm has technology that supports both liquefaction and regasification, allowing for the firm to benefit from both ends of the market.

The LNG market may be a fruitful industry for Emerson to partake in.

US capacity is expected to grow from 14Bcf/d in 2024 to 24.4Bcf/d by 2028.

European capacity is expected to grow from ~344Bcm in 2024 to 406Bcm by 2030.

The Asian market is expected to grow from 270MTPA in 2024 to 510MTPA by 2050.

Note that the Asian market includes China & India, two regions that are significantly underserved in the gas market.

The industrial automation market poses significant growth over the next few years.

US market growth: 10.6% CAGR 2025-2030.

European market growth: 8.26% CAGR 2025-2030.

APAC market growth: 11.6% CAGR 2025-2030.

Management is expecting roughly 80MTPA+ per year to be awarded to EPC firms over the next three years, providing significant uplift in earnings potential for Emerson. Accordingly, 1MTPA translates to $10mm for automation content with a 50% win rate across the full portfolio and a 50%+ win rate for its control systems in larger LNG projects. Accordingly, Emerson has won contracts for control systems on 6 of the last 11 LNG projects awarded. Management is expecting $1b+ in orders over the next few years in the LNG business. In total, 70% of the world’s LNG flows through Emerson valves.

Emerson services a wide range of industries across its various devices and software packages. One of the biggest value-adds is that Emerson’s hardware interconnects to its control systems software, providing a full-stack solution for customers across various markets.

In power and transmission & distribution, Emerson is focusing more heavily on traditional power over renewables. Renewables only accounted for roughly 10% of sales in FY24.

As part of its power business, Emerson’s technology includes its Ovation Control Systems, control valves, and AspenTech’s digital grid management software. Valves are found in combined cycle gas plants and nuclear power plants. Emerson’s control valves are found in 90% of the world’s nuclear power plants.

Ovation Control System currently automates 1.8TW of the electrical grid globally, or roughly 20%. 50% of the power generated in the US is on Emerson’s orchestration platform.

Given the large installed base, Emerson has a large and growing maintenance, repair, and operations [MRO] opportunity for steady revenue accumulation.

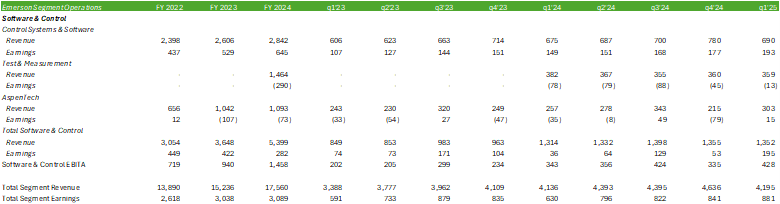

Emerson has undergone significant change throughout the last 5 years with a new management team and significant acquisition and divestiture activity. The overarching strategy is to scale its automation technology, which was further enhanced through the completion of its acquisition of AspenTech.

Emerson has a global presence with 50% of all sales being in the US, 30% in Asia, the Middle East & Africa, and 20% in Europe. Within the Asian market, China accounted for 11% in FY24.

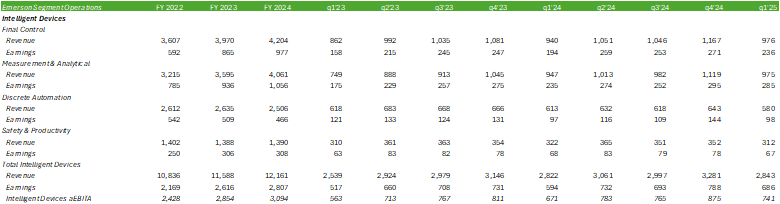

Business appears to be exceptionally strong for Emerson with the backlog growing by 8.7% in the last fiscal year. Emerson exited q1’25 with $7.3b in backlog.

Orders in q1’25 grew by 1% as a result of the challenging comps when compared to the previous year’s quarter. Emerson saw strength in demand in the Middle East and the US. This is reflected in energy & energy transition projects as well as capacity expansions and modernization in the chemicals market across both the Middle East and the US.

Demand for power was offset by weaker chemicals and discrete markets in China.

Emerson’s market segments are reflective of the current industry trends, with q1’25 orders improving in industrial, semiconductor, and discrete MRO, with offsetting performance in automotive and factory automation.

Discrete orders are expected to pick back up in eq2’25 with a significant improvement in e2h25 with control systems and software solutions driving demand.

In q1’25, Emerson released its DeltaV Edge Environment 2.0, a software package that bridges the gap between OT and IT through a secure channel. The feature aligns with the trends for more visibility on the factory floor, providing a secure data connection with translated data for advanced analytics. These features should enhance AI and machine learning capabilities at the edge or in the cloud environments to improve operational performance.

Tariff Impact

Emerson took significant action in 2018 when the US enacted Section 232 and Section 301 tariffs by derisking and diversifying its supply chain for raw materials, sub-assemblies, and finished goods. The firm also adjusted its pricing and surcharges to protect profitability at the time. These actions resulted in minimal impact to the 2018 import tariffs.

As it relates to the current tariff environment with China, management does not expect a material impact based on previous actions taken in 2018. Tariffs imposed on Canadian imports should be minimal given that Emerson does not have material exposure to the region. Mexico, on the other hand, falls into a similar situation as China in 2018. Management has taken action to implement price and surcharges on imported goods from Mexico to protect profitability.

Emerson Electric M&A

Emerson has undergone a series of acquisitions and divestitures over the years to rightsize and concentrate operations. The majority of companies acquired in the last 5+ years have enhanced Emerson’s automation technology stack, primarily in control systems, software, and autonomous machinery.

AspenTech – 2025

Emerson first acquired 55% majority interest in AspenTech in 2022 and acquired all remaining shares in March 2025 for ~$493mm.

Accelerated development of software-defined automation strategy.

Potential cash sale of Safety & Productivity segment as a non-core business unit. A carve-out would result in $1.4b in revenue reductions.

Copeland – 2024

Emerson sold its remaining interest in Copeland to Blackstone. Blackstone acquired majority stake in Copeland in May 2023.

Copeland was Emerson’s climate tech, which focused primarily on the global HVAC and refrigeration market.

NI – 2023

Emerson acquired NI, a global leader in test & measurement for an equity value of $8.2b.

Enhanced Emerson’s exposure to discrete end markets, such as semiconductors, electric vehicles, electronics, and aerospace & defense.

Expected cost synergies of $165mm by the end of year 5.

Afag – 2023

Afag enhanced Emerson’s factory automation capabilities with electric linear motion solutions, adding to Emerson’s pneumatic motion technology.

Primary markets served include battery manufacturing, automotive, packaging, medical, life sciences, and electronics.

Flexim – 2023

Diversified into the German market with over 100,000 connected flowmeters.

Markets served include chemical, water & wastewater, life sciences, food & beverage, and power generation.

Additional recent divestitures include InSinkErator and Therm-O-Disc.

Emerson’s acquisition of AspenTech may be a major catalyst for integrated growth for autonomous IoT/OT. This creates one of the most complete technology stacks in the market, inclusive of Zero Trust Security.

In addition to this, Emerson is in the process of putting its Safety & Productivity business up for sale. This market segment is more geared towards the consumer market, including its RIGID and ProTeam tools, cleaners, and diagnostic systems, etc.

Emerson Electric Financial Position

Management is expecting revenue to grow in the range of 1-2% in eq2’25 with an uplift in the back-half of the fiscal year. Margins should reflect improved pricing as the firm faces certain tariff risks to imports from Mexico. Margins should also improve in the firm’s Software & Control segment as AspenTech is further integrated into operations.

Emerson has a cash position of $2.8b and $4.8b in debt on the balance sheet. The organization has $1,029mm in debt due throughout eFY25, which can be more than covered through cash on the balance sheet or free cash flow. In terms of shareholder returns, management is targeting $3.2b for eFY25. With free cash flow expecting to come in at $3.2-3.3b for eFY25, the firm should be able to cover both the debt payments and shareholder returns through cash generation and cash on the balance sheet. The firm has a low leverage ratio of 1.07x net debt/EBITA, providing the firm with significant flexibility in refinancing or paying down this debt load.

Catalysts

Bull Case

Growing LNG capacity will drive growth in Emerson’s control systems and intelligent devices

New power capacity in support of data center growth may drive an increase in business in Emerson’s power market.

Reshoring manufacturing operations can drive growth in discrete automation but may take a few years before growth materializes.

The MRO business should grow at a steady rate as the firm expands its technology across markets.

The automotive market may provide an uplift in the coming years as manufacturing migrates to the US.

Bear Case

Uncertainty remains a major challenge in the market with tariff policy being updated almost daily.

Some economists have raised concerns over the risk of a recession occurring in 2025, with J. P. Morgan increasing the likelihood from 40% to 60%.

New power plants built to support new data center capacity may not be connected to the grid and potentially may not utilize Emerson’s grid orchestration software.

Renewable energy is generally falling out of favor, potentially leading to a decline in business.

Valuation & Shareholder Value

Emerson repurchased $1b in shares in q1’25. Management is expecting to return $3.2b in cash to shareholders through $2b in share repurchases and $1.2b in dividend payments. Though the dividend only yields 2.01%, this can provide significant value in connection with the growth potential for EMR shares.

EMR shares have historically traded at a relative premium to the market with a midpoint of 18.41x EV/aEBITA.

EMR shares appear to be entering into the next upcycle after falling by -29% peak to trough since the beginning of 2025. Given the tariff risk mitigation efforts and the growth story, EMR shares very well may return to their recent highs or beyond.

From a fundamental valuation perspective, $125/share is my base-case scenario at 14.49x EV/aEBITA. Looking at the historical trading premiums, EMR shares very well could trade as high as $181/share. I’m expecting a strong midpoint at $141/share at 16.23x eFY26 EV/aEBITA.

Using the model: the valuation table above references my financial forecast in the firm’s “financial position” section and ties it to the stock’s historical trading premiums. The trading premium array is derived through the normal operating cycle with the blue-sky scenario being the stock’s peak multiple and the gray-sky scenario being the lowest point. The target multiple aims for the midpoint, or the most likely trading range for the company’s stock. The trading multiples from there are set to a probability factor based on the likelihood of the stock trading at that premium based on its historical presence. From there, the trading multiple is tied to the probability factor to derive its relative marketcap and relative multiple.