Regional banks are primarily focused on bridging the gap between saving and loans. On the liabilities side of the balance sheet, regional banks tend to offer commercial banking products and services, including personal & business checking, retirement, money market, and time & savings accounts. On the client side of the business, which are defined as assets for the banking sector, regional banks offer loans to both consumers and commercial businesses, revolver lines of credit, commercial & residential mortgage loans, and commercial construction & real estate loans, amongst other lending services.

Essentially, regional banks are the intermediary between deposits and loans. This is a critical feature, particularly for smaller organizations that may not have access to the capital markets for raising capital. As of April 2025, the private corporate credit market was valued at $1.5T in the US, whereas the total US loan market is valued at $12.6T.

In general, the market for private credit may be becoming more competitive with private equity firms entering the market. Firms like Blackstone, Apollo Global Management, and KKR enter the private credit market, directly lending to businesses while operating outside of the regulators overseeing the traditional banking system. Though it is still early on, this could potentially lead to a race to the bottom for spreads, potentially resulting in tighter interest margins for traditional banks.

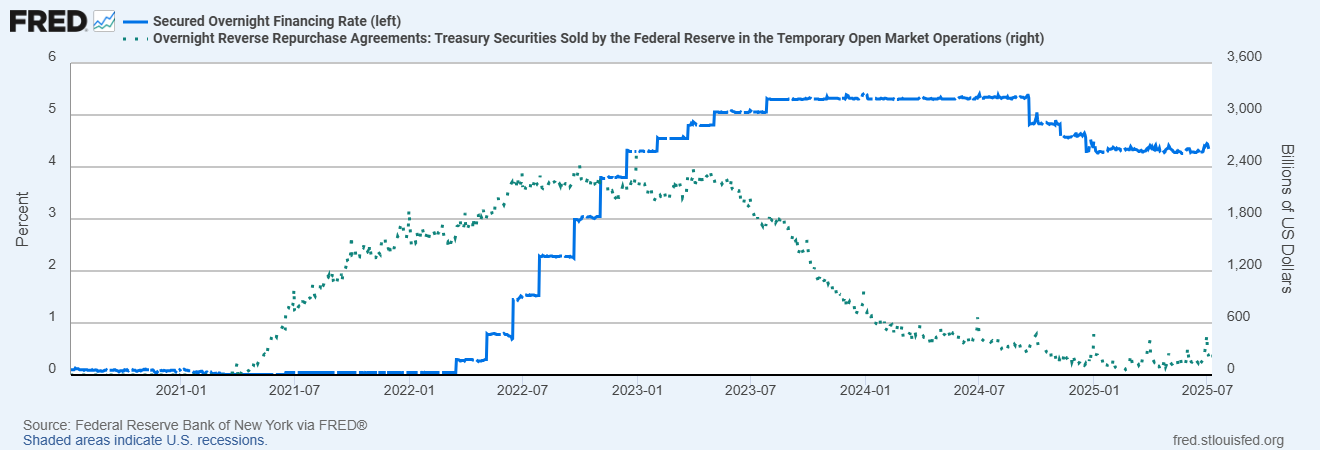

Banks primarily earn interest on loans outstanding relative to the cost of interest on deposits. Net of non-interest-bearing assets, the net interest rate spread, or the difference between interest received and interest paid through loans and deposits, provides us with net interest income. Loans are generally issued at a spread above a reference rate, oftentimes using the Secured Overnight Financing Rate [SOFR] in the US.

This makes regional banks relatively sensitive to changes in the Federal Funds Rate, which acts as a reference rate when determining the interest rate on a loan or interest paid on deposits.

Periods of increasing (decreasing) rates can create headwinds (benefits) on a bank’s loan book particularly when the economy undergoes periods of stress. Market yields can significantly impact the value of a bank’s asset book. The value of a loan and the market yield have an inverse relationship, meaning that loans held may experience an unrealized loss during a period of increasing rates and vise versa.

The banking industry can be susceptible to economic stress and stagflation, resulting in certain risks that investors must be aware of in the industry.

Stagflation is by far one of the biggest risks to regional banks. Stagflation is the economic phenomenon of high inflation with stagnant economic growth. The risk involved is incurring more deposits relative to issuing loans, resulting in a narrowing of the bank’s net interest margin.

Economic stress has the possibility of depositors seeking to withdraw their funds, potentially resulting in a lack of liquidity for the bank to function as a lender.

Macroeconomic uncertainty and changing rate policy can create substantial risks for regional banks, primarily in maturity mismatching. This means that the long-term assets, or loans, do not align with the short-term liabilities, or deposits, creating mismatch risk that may lead to liquidity challenges for the bank. This is essentially what occurred back in March 2023 with Silicon Valley Bank (SVB) which resulted in a catastrophic bank failure.

The commercial real estate [CRE] market can also create certain headwinds for regional banks, depending on the bank’s loan book. According to a 2024 report issued by Reuters, CRE loans account for roughly 44% of regional bank balance sheets compared to 13% for the larger banks. Accordingly, roughly $1b in CRE mortgages are set to mature in 2025 with a significant proportion expected to default, adding significant risk to the regional bank sector. With office and apartment values declining 20% from their peak, value may be challenging to extract in the instance of a default or forced sale.

Growing office vacancies have created substantial stress on the CRE market. As of q1’25, the vacancy rate has climbed to 20.8%, likely resulting in the declining in asking rental rates.

Exposure can vary by bank and may not be as significant as one may expect. Picking out ConnectOne Bancorp (NASDAQ: CNOB), 71% of the bank’s loan book was in commercial real estate in q1’25. As a result of the stress to the CRE market, the bank has engaged in interest rate modifications to only 1% of the bank’s CRE loan book. Though this is a relatively small figure, it is above the 2024 average of 0.81% across US banks. Depending on the market environment going forward, modifications may increase in order to maintain the solvency of the lendee.

How to Invest in Regional Banks

There are certain measures to consider when seeking to invest in regional banks. Regional banks are generally rangebound at roughly 1x price-to-book value. This can potentially be a limiting factor for the regional banking sector as growth in loans and deposits are necessary to generate value.

Net of capital returns, regional banks can enhance shareholder value through a number of benefits, including share buybacks and dividend distributions.

Investors must consider the economic condition under which the bank is operating when evaluating regional banks. During periods of economic stress, the Federal Reserve may impose restrictions on share buybacks for banks and in certain circumstances suspending them as seen in June 2020. The Federal Reserve may also cap dividend distributions under similar circumstances. These initiatives aren’t necessarily designed to penalize banks but rather, preserve capital in order to ensure banks can continue lending operations during periods of economic crisis.

Following the recent economic crisis in 2020, the Federal Reserve allowed banks to resume share buybacks and dividends in q1’21 with limitations relative to the banks’ trailing twelve-month average net income. The temporary restrictions were inevitably lifted in q2’21 under the presumption that the bank passed the annual stress test and remained above the minimum capital requirements.

M&A

Given the broader saturation of the banking industry, a substantial amount of value can be uncovered through M&A deals across banks. 2021 saw 208 deal announcements with national deals closing at roughly 1.52x Price/TBV. M&A activity slowed down in 2023 to only 90 deals completed in the year with activity dwindling down to date. Despite this factor, regional banks remain well-priced as an investment opportunity with valuations in the range of 0.8-1.2x P/B.

Using data collected from Fiscal.ai, there are currently 64 regional banks in the US with marketcaps in the range of $500-1,000mm, 31 of which have a price/book value in the range of 0.8-1.2x.

Risks Related to Regional Banks

Despite the appealing valuations, regional banks may face heightened scrutiny that may lead to higher costs to operate. There are a number of new regulatory features to consider across the smaller, regional banking cohort.

Regional banks with assets of $100b will now be required to hold more long-term, loss-absorbing debt in order to minimize stress on deposit funding. This means that these banks will be required to increase their debt assets by roughly $70b in order to remain compliant with the FDIC proposal. This could potentially add certain duration risk to banks’ balance sheets, particularly during periods of rate increases. This could also lead to a mismatch of assets and liabilities, leading to instability.

Regional banks with over $50b in assets will need to submit living wills to regulators, outlining plans in the event of bank dissolution in the event of failure. This regulatory proposal requires banks with over $100b in assets to provide an “identified strategy” that the FDIC could effectuate in the case of failure. The proposal would also require banks to produce valuations that can be audited and used by the FDIC at the time of a failure.

In addition to this, regional banks are becoming more heavily scrutinized as it relates to consumer protections and anti-money laundering programs. The total spending across banks for AML programs are projected to reach $51.7b by 2028. AML and other compliance costs can potentially result in substantially higher costs to operate for smaller banks, potentially making M&A activity more appealing to manage costs.

Final Thoughts

The regional bank industry may be facing higher costs in the coming years as regulatory compliance becomes more stringent, potentially leading to more M&A activity to mitigate certain risks to profitability. This can provide investors with substantial upside potentially, particularly when considering the average price/book multiples across the $500-1,000mm regional bank cohort and the premiums sought in these deals.

In general, regional banks are more sensitive to interest rate changes when compared to larger investment banks given the dependence on matching assets and liabilities. Comparing the SPDR S&P Regional Banking ETF (NYSEL KRE) to SOFR, we can visually observe that the banking index has an inverse relationship to the key rate. During a downward rate cycle, we can generally expect regional banks to perform well as the cost of liabilities is reduced while the value of assets appreciates.

ConnectOne Bancorp (NASDAQ: CNOB)

This week we will be pivoting to the regional bank sector, covering ConnectOne Bancorp (NASDAQ: CNOB). The idea was brought forth as part of a white paper on the regional banking sector. Though this hasn’t been an industry of focus in this newsletter, there may be some value to extract as part of a merger-arbitrage theme. The sector has undergone substantial M&A activity in the last 5 years as a result of mounting compliance costs following the failure of Silicon Valley Bank in 2023, opening the door for premium buy-outs.

Today, major risks investors must consider is the loan book in the face of elevated interest rates and increasingly uncertain economic conditions. This primarily relates to commercial real estate loans [CRE], inclusive of multifamily builds, maturing in the next few years as well as commercial loans as they relate to economic challenges in the face of mounting costs relating to import duties.

Regional banks oftentimes service smaller organizations that do not have access to the capital markets, resulting in private lending-type practices. This can bear substantially more risk when compared to public bond issuances that can be syndicated and dispersed across investors, reducing the risk on the bank issuer.

At the end of q1’25, ConnectOne had $8.2b in loans on its books, a marginal sequential decline and a -1.2% decline when compared to the previous year’s quarter. CRE and multifamily loans accounted for 71% of ConnectOne’s total loan book, potentially adding certain risks given the state of the market today. With rising vacancies across office buildings and elevated rates making multifamily facilities less profitable net of interest payments, risks may be heightened on the back of economic uncertainty. Roughly 1% of ConnectOne’s CRE loans have had interest rates modified in order to keep the loans solvent. Though this figure may be relatively small, it is above the national average of 0.81%.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.