Monte Independent Investment Research Vol. LXIX

Trade Update; ISM-PMI Update; The One, Big, Beautiful Bill

On Today’s Agenda

Trade Update

ISM-PMI Update

The One, Big, Beautiful Bill

Sizing Up

The goalpost was pushed back to August 1, 2025, in which heightened tariffs will be imposed on countries that do not strike a trade deal with the US. CNBC reported that 12-15 letters will be sent out to respective countries to indicate the final offer for a new trade policy. Accordingly, these are “take it or leave it” offers, meaning that this is the bottom-line because Donald Trump said so.

US Secretary of the Treasury Bessent suggested that we should have more information within the next 48 hours as trade proposals flood in and may potentially result in an array of new deals to be announced in the coming days.

Though the possibility of a return of the Liberation Day-level tariffs for some countries, it is very unlikely that the majority of trading partners will falter to this level. The countries to be keen on include Canada, Mexico, Japan, and the EU. Much of this derives from the automotive industry; however, based on historical trade tariff negotiations, the industry appears to be under a separate set of negotiations, similar to steel and aluminum.

Though China may be a risk to consider for trade negotiations, the country’s 90-day deadline isn’t until early August.

Japan is 50/50 in that the country has been actively coming up with concessions for a trade deal with automobiles and agriculture being the sticking points.

As referenced in my report covering Toyota Motors (NYSE: TM), the organization may be somewhat shielded given its manufacturing footprint in the US.

Liberation Day shaved something like -11% off the S&P 500. Though a catastrophic turn of events could occur the next day, I suspect the market’s reaction will be much tamer by comparison given that the worst-case scenario is known and should not surprise the market this time around. Information is being slow-dripped into the market; we know that 12-15 countries may not be receiving a firm trade deal prior to the deadline.

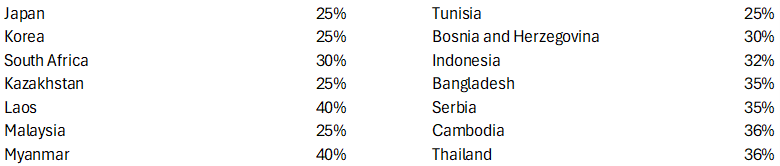

Late Monday afternoon, the Whitehouse released the list of countries and their respective reciprocal tariffs that will be imposed on August 1, 2025.

Macroeconomic Update

ISM-PMIs were somewhat promising for June 2025 with Services returning to expansionary territory at 50.8% and Manufacturing contracting at a slower rate at 49% [50% is the midpoint].

The figures from both reports would suggest that inventories may have been replenished following May’s massive decline in imports. This was likely following the pause on trade tariffs, allowing firms to pull forward purchases in order to mitigate near-term margin risk.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.