Monte Independent Investment Research Vol. LXVIII

q2'25 Recap; What to Expect in q3'25

On Today’s Agenda:

Quarter Closing Thoughts

What to Expect in q3’25

We will not be publishing a report on Friday, July 4, 2025, in observance of the 250th anniversary of American Independence.

End of Quarter Thoughts

We have experienced a substantial amount of turmoil year-to-date, particularly with the market rally that resulted in the S&P 500 reaching all-time highs in q2’25. Within our universe, industrials have led the way followed by technology. Though this wouldn’t normally be expected given the relatively low interest in the sector, the market appears to favor industrials as they are likely to benefit most from trade tariffs.

I know what you’re thinking: tariffs will lead to inflationary pressures, an imbalance of supply & demand, and lower volume sales. Perhaps all this will pass; but one must remember that many of the products manufactured are components destined for other industrial and enterprise end-markets. They can foot the bill as many of these components, particularly those found in power transmission & distribution and data centers, are critical for growth. Though some budgets may be flexible while others more restrictive, price/quantity is expected to remain positively balanced.

Technology led a substantial amount of growth in the index, driving 8.73% growth across the sector. Net of Apple (AAPL), the technology industry performed relatively well with a few laggards at the top.

YTD, Amazon (AMZN), Alphabet (GOOG/GOOGL), Tesla (TSLA), and Apple lagged the broader market with AAPL shares declining by nearly -18%.

Again, no surprises here as Apple has faced numerous challenges with reigniting growth across the consumer market. With a flagging headset paired with challenged consumer discretionary budgets, Apple isn’t necessarily best positioned for growth for the remainder of 2025.

TSLA was the second biggest laggard, declining by nearly -16% YTD. The EV maker has faced numerous challenges in maintaining interest in vehicle purchases, facing political risk with Elon Musk joining DOGE. The EV maker is also entering into the next phase of growth with the emergence of its robotaxi program in Austin, Texas. Though the program isn’t necessarily as splashy as Musk made it out to be, the organization is playing it safe, slowly deploying supervised, self-driving vehicles before providing unsupervised services to ensure minimal risk regarding traffic incidents and more likely, theft and vandalism of the vehicles.

The biggest gainers in the S&P 500 were META and MSFT, 23% and 19% respectively. This also comes as no surprise as META is entering a phase of more efficient business development through the use of GenAI across its advertising platform. With autonomous ad generation, advertisers can increase ad spending without increasing overhead costs.

MSFT is also positioned for substantial growth as the hyperscaler exhibits the lowest exposure to consumer constraints and tariff risk. MSFT has remained an enterprise-oriented business with fractional exposure to the consumer through its gaming & consumer devices businesses. The primary growth driver remains the same: cloud computing. With capital spending expected to be notched up in the coming quarter, MSFT is well-positioned to feed the flywheel.

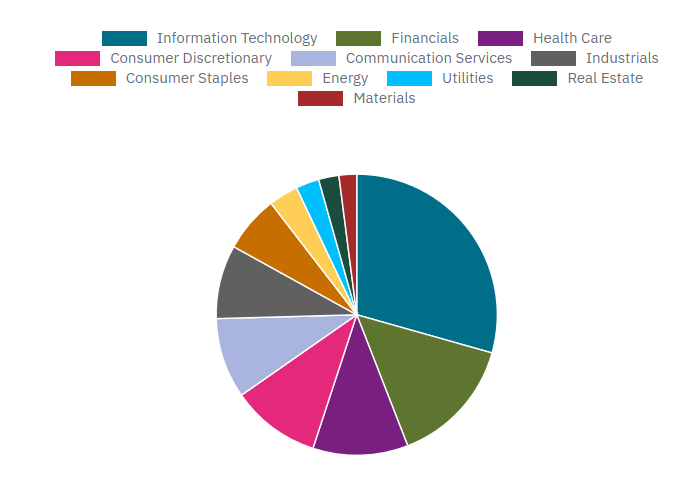

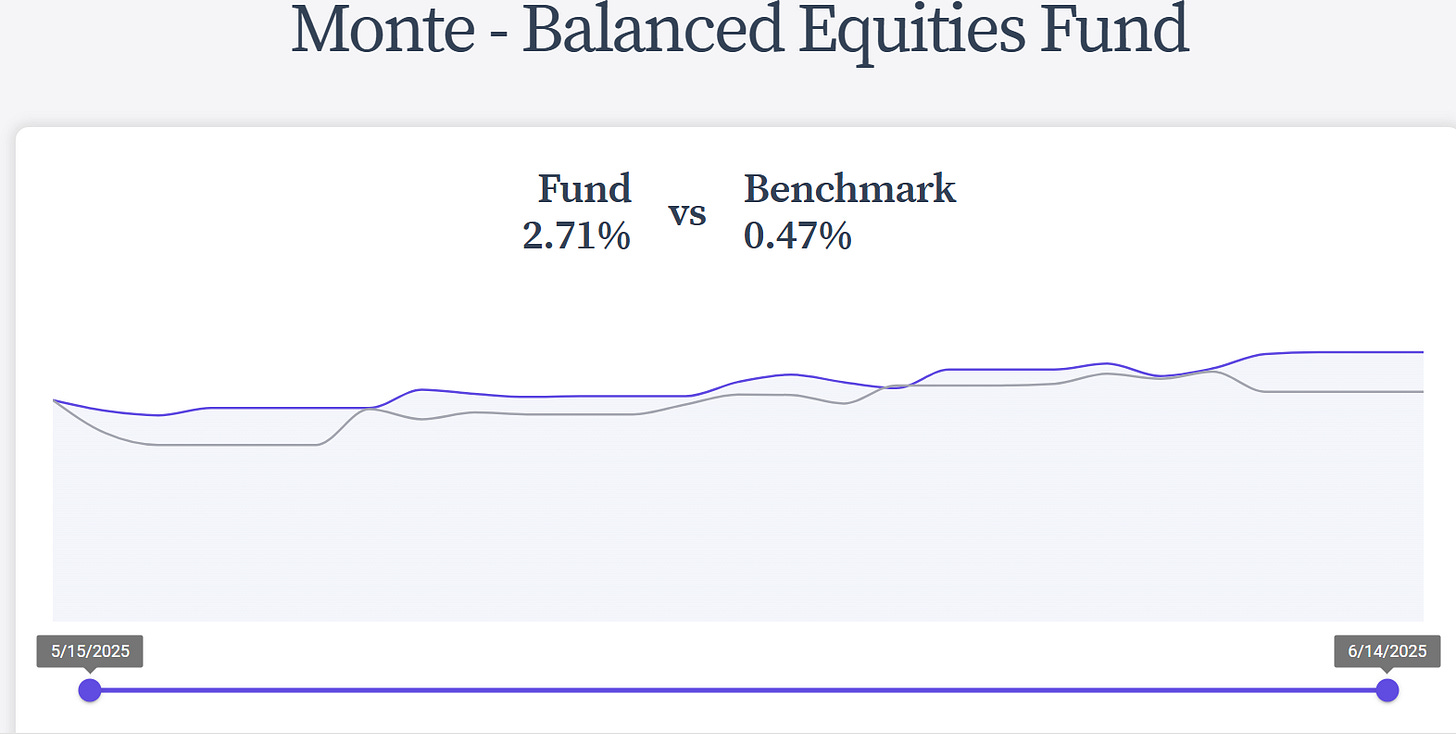

Looking at the model portfolio performance, we’ve outperformed the S&P 500 by over 2% since we were launched on Quantbase in mid-May. For those that may be interested in buying into the model, we designed the balanced strategy as an all-inclusive equity portfolio, providing investors with exposure to growth, value, income, and event-driven investments. You can either buy into the portfolio directly through Quantbase’s automated portfolio management platform, or manually input the trades as part of the provided model at the end of this newsletter.

What to Expect in q3’25

Looking ahead to q3’25, I’m anticipating continued growth across our investment universe in technology and industrials. With reshoring continuing to take shape, industrial automation should pick up steam, driving the need for connectivity and AI infrastructure.

The beginning of q3’25 will be splashy with the expiration of the 90-day tariff pause. With a few EU countries defecting from collective bargaining, or collusion, we may expect some disruption to trade flows early on. I suspect trade negotiations will go well beyond the July 9, 2025 deadline given the sticking points across continents. One of the biggest points is the EU’s approach to regulating US technology companies, essentially creating an anticompetitive environment.

Canada appears to be easing up on trade talks, backing out of the stonewall approach initially taken after President Trump fought back with escalation. This follows the increased tariffs on imported steel and aluminum, going from 25% to 50%. Though this may impact US production, I suspect the price support will be more beneficial to the US steel industry as opposed to being destructive to the overall market.

I’m expecting a similar chain of events to occur within the EU:

The EU does not take the tariff threat seriously and punts.

Trump reinstates the sky-high tariffs across the bloc.

The EU will attempt to retaliate with reciprocal tariffs.

Trump will raise the rates even further.

Individual countries will crumble under pressure, defect from the cartel negotiation tactic, and individual countries will strike deals with the US.

The vehicle market really places the EU into a stranglehold. As Chinese sales dwindle, the US is really the only needle-moving export market for the higher-end European vehicles.

One key risk that the US faces in negotiations is the risk of inflation paired with elevated interest rates. It’s no secret that President Trump disagrees with Jerome Powell’s rate policy in place, holding the Federal Funds Rate at 4.25-4.50%. Tactically, with prices expected to rise resulting from trade tariffs, capital will need to be more accessible to ensure companies can continue investing in growth projects.

Without easy money may come harder times.

Looking at trade with China, I suspect negotiations will continue with each side treading lightly in an attempt not to spiral talks out of control. As of June 11, 2025, the US has a 55% imposed tariff on Chinese imports while China has a set 10% tariff rate of US imports.

One of the core sticking points for the US is securing an adequate amount of rare earth elements while China wants less restrictive access to US semiconductors. To replace the H20, Nvidia (NVDA) has developed the next generation of AI accelerator to be approved for sale to China, the B30. Given the positive movement towards an agreement, I suspect Nvidia will be granted certain access to sell these GPUs in the coming quarter or two.

Overall, tariffs are here to stay. The only question is: at what level will they land?

Thematically, I believe our core tariff proof trades will be the way to play this. Here’s a short list of companies that may end up ahead of the competition:

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.