Monte Independent Investment Research Vol. LXVII

Oil & Natural Gas Markets; Geopolitics; Tesla FSD; MLP Assessment

On Today’s Agenda:

Geopolitical Strike

Oil & Gas Markets

Tesla’s Make or Break Moment

MLP Overview

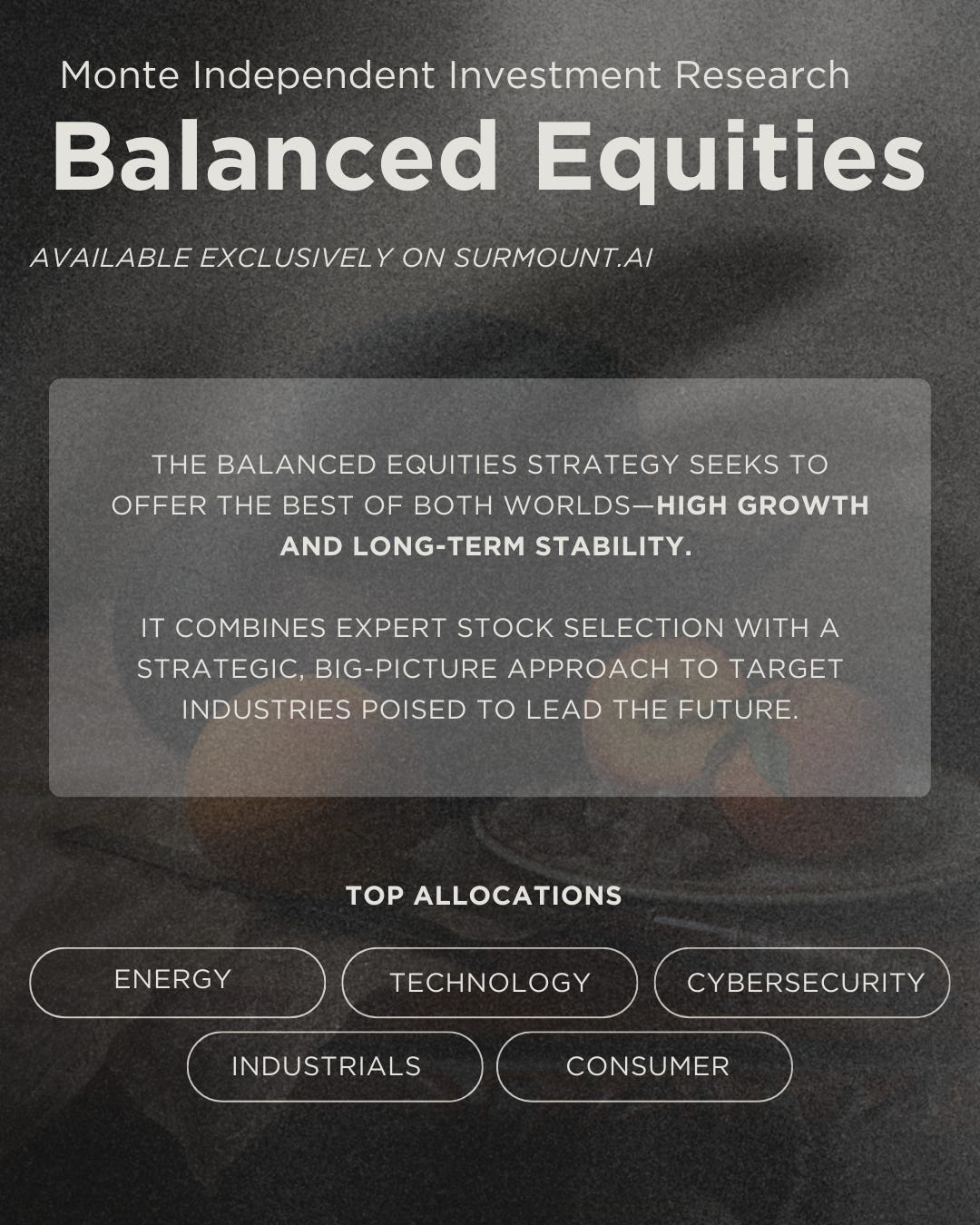

In partnership with Surmount & Quantbase, you can now directly invest in the model portfolio, Monte - Balanced Equities Fund.

Geopolitical Strike

The big headline circulating came from over the weekend with the US striking Iran nuclear facilities with the infamous Bunker Buster Bombs. Iran retaliated on Monday, June 23, 2025, by launching missiles on Al Udeid Air Base in Qatar. Though the rocket was intercepted by Qatar, this raises significant concerns for escalation, and may potentially lead to an increased presence of US troops in the region. Since the strike, President Trump announced a cease fire between Israel & Iran.

Though the US’s involvement was momentary, the markets appear unscathed, increasing by 1% at the close.

The market reaction on Monday was relatively positive with WTI reaching a high of $75.55/bbl. Some are calling for oil to potentially reach $120/bbl if attacks escalate, potentially posing significant pressure to headline inflation.

Natural gas didn’t necessarily have the same reaction to the news as the oil markets, which comes as a surprise given that Iran is the 3rd largest global gas producer.

Nonetheless, our natural gas equity basket remains in a position of strength with EQT and EXE remaining stable growers while APA extends ground.

Our two Permian oil producers have been making up some ground in the last month. As a reminder, we rotated out of these oil producers at the beginning of the year in favor of dry gas producers.

The Wall Street Journal reported an interesting article last week that came as a surprise.

The world’s largest lenders committed $869.4 billion to companies conducting business in fossil fuels in 2024, according to the “Banking on Climate Chaos” report published on Tuesday. This was 23% higher than the previous year and is equivalent to the gross domestic product of Switzerland.

I found the article quite interesting as it raised concerns about the financial sector’s commitment to climate goals, despite the major banks backing out of these commitments in December 2024 through January 2025. Either the WSJ is late to the party or is attempting to come off as an alarmist. Either way, this is a major turnaround from the significant decline in financing experienced since 2019.

Though the O&G industry of 2025 doesn’t resemble the same wildcatter style seen a decade ago, the industry is still alive and well. The main theme in the last 5 or so years has been a disciplined investment approach to production, which has held up to this day. In turn, this has resulted in significant free cash flow and shareholder returns. Granted, the fixed + variable dividend theme has largely fizzled out in favor of share buybacks; shareholder returns remain a priority.

Taking into consideration producers’ balance sheets and cash flow, the companies operating today do not resemble the same financially challenged operators of 2015. Profitability has significantly increased with improved drilling & completion and enhanced oil recovery techniques. Leverage positions have significantly improved, alleviating operators from high interest payments for production. Capital investments have balanced out for positive free cash flow as fewer wells and rigs are needed to yield similar production. The industry is certainly healthier than it once was and less dependent on debt to maintain the investment-turned-growth flywheel.

Tesla’s Make or Break Moment

Tesla officially launched its Robotaxi program on June 22, 2025, with a small fleet of self-driving Model Y vehicles. The stock jumped by 10% following the limited program release. Elon Musk has placed a lot of faith in the Robotaxi program, weighing heavily on the future of Tesla as electric vehicles fall out of favor by consumers.

You can read my previous coverage of TSLA here:

Tesla's Robotaxi Revolution Begins In June - Growth May Already Be Priced In

According to the CNBC report, a Tesla Safety Monitor will sit in the front right passenger seat during all trips in order to ensure a safe journey. The program excluded trips to the airport, likely suggesting that the initial program is designed for short-range travel to ensure safety and maneuverability.

Despite the promising program, Texas lawmakers are pushing back, making the attempt to postpone the launch of the Robotaxi program to September 1, 2025, despite Tesla receiving full approval to trial the program. The concerns from lawmakers come down to safety, which is completely understandable given Tesla’s approach to FSD.

Tesla’s aim is to run a generalized AI model for FSD. This is in contrast to Waymo’s use of GPS for travel. Accordingly, utilizing machine vision has the capability of creating a more perfect FSD program; however, it may require substantially more trial and error before being perfected. The lawmakers pushing back presume that a perfect model can be released up front, which is near impossible given the immense variability of human error when driving.

Having the Tesla personnel in the vehicle during the test period is prudent for ensuring that variability in the AI model doesn’t result in a wreck. I suspect that onboard human supervision will remain for a trial period before moving to remote supervision, and inevitably, unsupervised FSD.

MLP Overview

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.