This week we’ll be reviewing Gulfport Energy Corporation (NYSE: GPOR), a natural gas pureplay with acreage in the Utica & Marcellus shale around Ohio in the Appalachia region and SCOOP shale assets in the Anadarko Basin in Oklahoma. Gulfport has gone through quite a ride over the last few years as the firm underwent an activist shareholder intervention, bankruptcy, and reemergence from said bankruptcy.

Back at the start of 2019, FireFly owned 8.1% of GPRO shares and took action in an attempt to reignite value for shareholders. Much of the involvement was related to Gulfport’s lackluster stock price performance paired with equity issuances in a time of challenging gas prices. As a result of this activist activity, Gulfport did a complete 180 and initiated a $500mm share repurchase program, restructured their board of directors, and began to better align the company’s strategic operations to benefit and create shareholder value.

Not long after FireFly’s shareholder letter to Gulfport, Gulfport initiated a corporate restructuring, a recapitalization in which the firm reduced their debt load and repurchased equity, and turned over their board of directors. The firm also began selling off non-core water infrastructure and Utica shale assets to optimize operations.

Fast forward to 2020, the firm was hit hard by the natural gas bear market. Like other gas pureplays, Gulfport found major headwinds as the firm produced at a major loss in 2019 & 2020 and in November 2020, filed Chapter 11 bankruptcy. Shortly after in May 2021, the firm reemerged in a fresh position, restructuring their debt from a $1.2b load down to $853mm for a 1.5x net debt/EBITDA ratio. With the restructuring came 5 new members to the board of directors, and a new CEO and CFO.

Comparing Gulfport then and now, the firm is in a much stronger position with a leverage ratio of 0.99x with $673mm of net debt on the books, and a strong operational outlay that is strategically hedged to normalize cash flow during times of volatile gas prices.

Gulfport Energy Operations

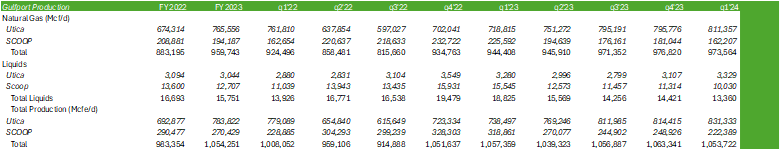

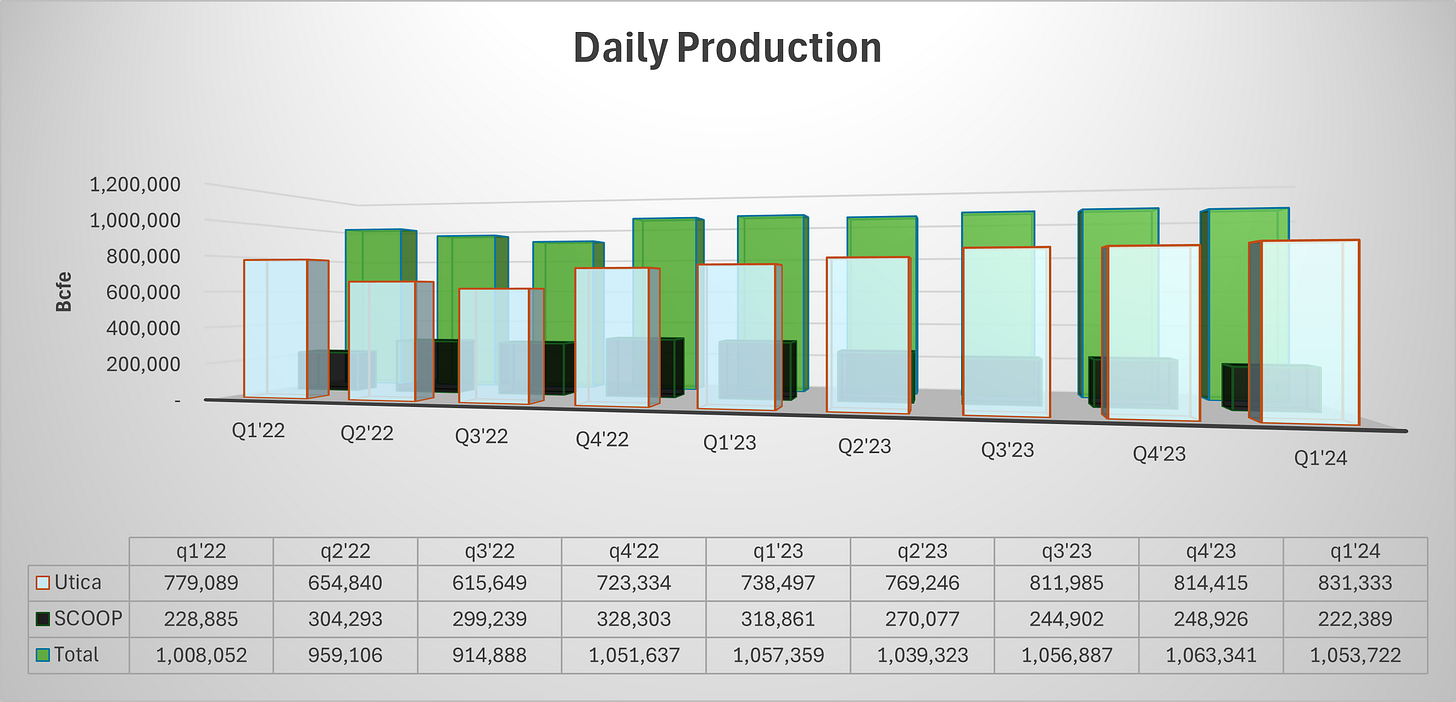

Gulfport is about as plain vanilla as it gets when it comes to gas production. That’s the business the firm is in and all they do. Gulfport’s asset outlay is split between more liquids-rich SCOOP assets and the more gaseous Utica shale. This allows the firm significant flexibility to shift production from one region to another based on commodity pricing. Given the backwardation of WTI and the contango effect of natural gas, Gulfport is leaning more heavily into gas production across their Utica assets.

Like other gas producers, Gulfport is facing a challenging gas market in the near-term as spot remains at depressed prices. What differentiates Gulfport from others isn’t necessarily that they hedge their production, that the relatively high price their gas is hedged at with an average floor of $3.67/Mcf, well above the strip price through November 2025, and a ceiling of $5.14/Mcf, well below the strip curve. The firm has roughly 60% of their remaining 2024 gas production hedged at this rate while building their eFY25 hedge position, which currently covers 380MMcf/d with an average floor of $3.68/Mcf.

This position has bode well for Gulfport throughout FY23-24. Aside from q2’23, Gulfport has managed to maintain positive free cash flow despite the challenging gas market. As management denoted in their q1’24 earnings call, they will be playing offense while other producers are playing defense. In reviewing other gas producers, this is a very accurate statement in which Gulfport has remained focused on returning cash to shareholders whereas other gas producers have focused almost solely on fortifying their books. Despite this offensive move, Gulfport’s leverage ratio only sits at 0.99x net debt/aEBITDA, a strong positioning when compared to other producers in the dry gas arena. The only comparable downside to holding GPOR shares next to other gas producers such as CHK or SWN is that Gulfport does not pay out a dividend to common equity holders. Despite this matter, this is a phenomenon that institutional investors are looking for: favor buybacks over dividends.

Considering GPOR’s historical trading performance, traders do not appear to be that much concerned by the lack of dividends. In my view, this is one less headache for investors and management to worry about as gas prices face high levels of volatility paired with steep contango.

Given the firm’s cash flow generation, this strategy certainly has paid off for the most part. Despite a few periods of a negative effect on revenue, Gulfport has been relatively successful in recent years in hedging their book.

Though natural gas is priced with significant upside potential going out a year, there may be some challenges between now and then that can create a less-than-optimal production environment. As discussed in last week’s report, ExxonMobil’s & QatarEnergy’s primary contract constructor for the Golden Pass LNG project, defaulted on their construction contract for the facility, resulting in delays to operations. Reuters recently reported that this event will result in at least a 6-month delay due to this conundrum, which was the result in what appeared as a mismatch in Zachry’s cost forecast and cash flows. This headwind will essentially result in a drop of 15MTPA of LNG that I believe was baked into supply/demand estimates for domestic gas before the event occurred. This very well could send gas prices down if production volumes do not reflect the new demand forecast for the coming years. If gas prices remain depressed as a result, Gulfport may be well-positioned to weather the continuation of the bearish gas market before realizing an upswing when demand hits the domestic market.

Taking into consideration that management at Gulfport is currently building their hedge book for eFY25, they may be in a good position to adjust for these events to ensure they do not miss out on any pricing tailwinds when demand enters the market. Judging by their current strategy of pushing back drilling and completion to the back half of eFY24 or early eFY25, they may further draw down production to retain the value of their gas assets in the ground.

Management significantly pulled back on their D&C capital investment program for eFY24, forecasting a range of $330-360mm, or 10% lower than FY23 investments. The firm currently runs one frac crew in the Utica and will be utilizing a spot crew to complete 3 wells in the Angelo South pad in the SCOOP shale for a total of 5 gross wells and turn 3 gross wells to sales in eFY24. The forecast production rate for eFY24 is in the range of 1,045-1,080MMcf/d across all of their basins, keeping production flat when compared to FY23 flows.

Forecasting financials through eFY25, I anticipate Gulfport to continue to gain steam into the end of the year as the firm manages their drilling and completion program and their hedge book, which I anticipate will yield positively for the duration of eFY24. Though I do not anticipate a strong upswing to gas prices going into eFY25, I do anticipate management to maintain their strategy and to garnish strong free cash flow as a result.

Valuation & Shareholder Value

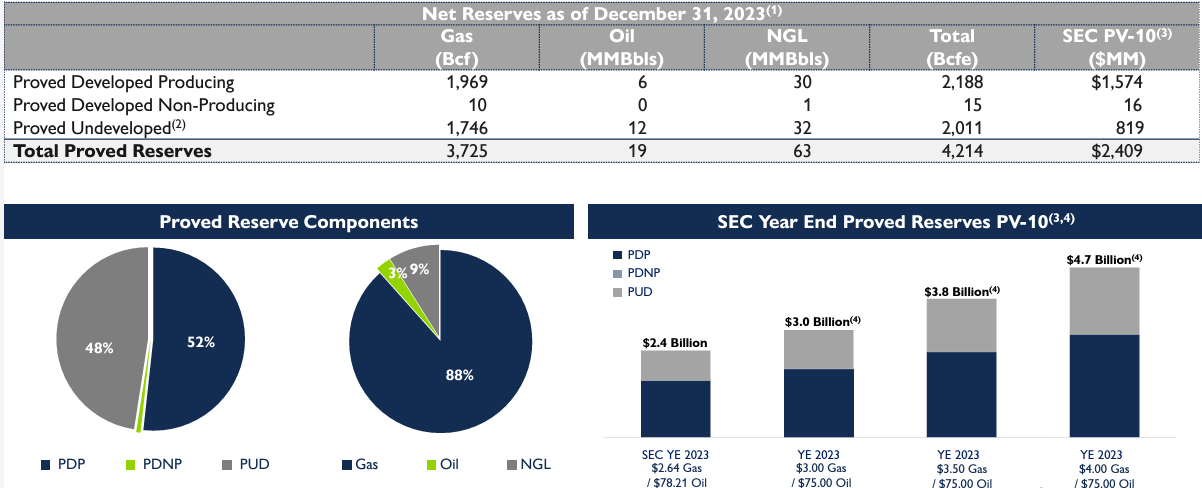

Looking to the firm’s PV-10 from the end of FY23, GPOR is valued at 1.22x book value of O&G assets, assuming $3/Mcf & $75/bbl oil and gas prices.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.