Constellation Energy (NASDAQ: CEG) Is A 2030 Investment

This week’s single-name stock report will take us back to the energy industry, specifically utilities. We will be taking a look at Constellation Energy (NASDAQ: CEG), a name that has made major headlines as of recent as a result of Microsoft (NASDAQ: MSFT) engaging with the firm to source nuclear energy through its remaining Three Mile Island nuclear reactor.

Nuclear energy has been making major headlines throughout the last few years as nations and enterprises alike seek to source low-carbon, reliable power sources. This has been a global initiative as European countries and Japan have engaged in bringing existing nuclear power plants back online.

In addition to this, President Biden laid out the goal of tripling the existing nuclear power capacity by 2050, bringing US nuclear capacity to 200GW. The mid-term goal is to add 35GW of capacity by 2035. This target may be overshot with the strong interest by the hyperscalers to power new data center builds with nuclear energy.

As part of the government’s initiative to prioritize nuclear power, the ADVANCE Act was passed in 2024 in order to further the development of capacity. The act was designed to modernize the way plants are licensed, reduce the application fees, and bolster the NRC staffing for faster reviews in order to expedite the process.

Amazon signed a partnership agreement with Energy Northwest to supply upwards of 960MW of total capacity. Amazon also invested in X-energy to develop small modular reactors [SMRs] to supply 300MW of capacity, targeting the 2030s.

Alphabet signed an agreement with Kairos Power to supply 500MW of capacity by 2035.

Microsoft signed an agreement with Constellation Energy for 835MW of electricity at the Three Mile Island nuclear facility. Microsoft has also partnered with Helion to bring a nuclear fusion facility online by 2028.

So, not only does nuclear power generation have government support, it also has significant, actionable support from industry.

Despite this interest, there is some regulatory pushback as it relates to colocation sourcing. FERC rejected an interconnection service agreement on November 5, 2024, between Amazon Web Services and Talen Energy on a two-to-one vote; however, this is not the final word on data center colocation. Management remains optimistic that this will turn in favor of the utility as it will have the capability to accelerate data center buildouts.

From what it looks like, prioritization appears to be a major hangup. During times of stress, providing power to support the grid will need to be a priority. This means that nuclear energy intended to support collocated loads will be switched to the grid to ensure reliability. In addition to this, collocation plans will likely involve payment for grid costs to ensure grid resiliency.

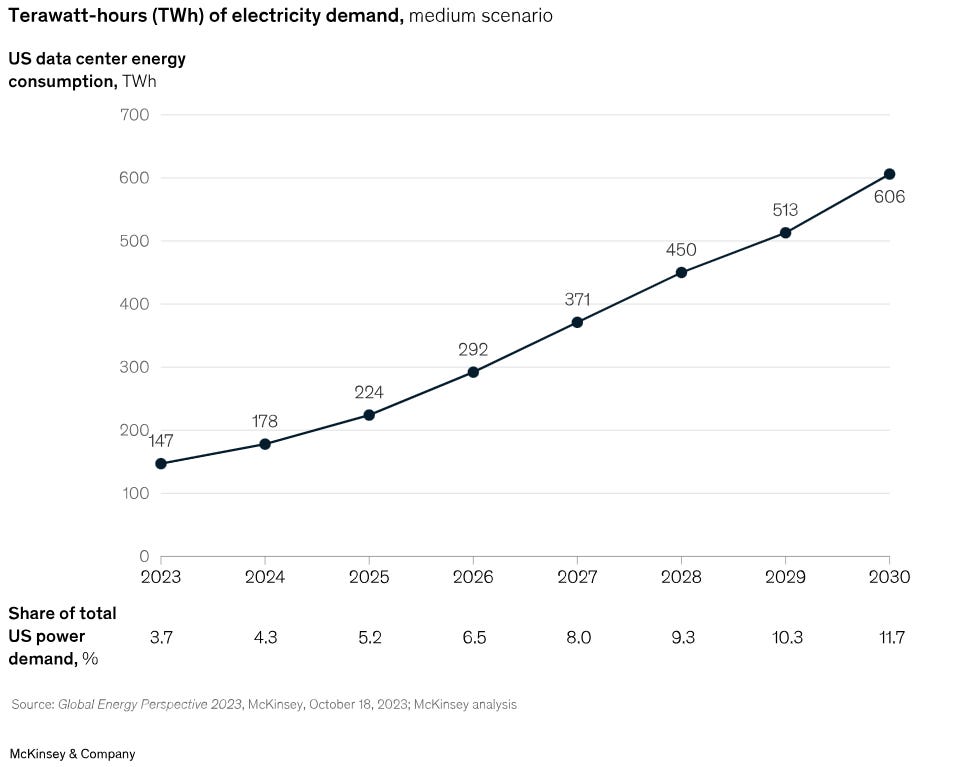

As discussed in my previous reports covering the hyperscalers, power generation will be the biggest constraint for new compute capacity. The data center footprint is estimated to grow at a 23% CAGR through 2030. According to McKinsey, data center capacity in the US is expected to grow from 25GW of demand in 2024 to more than 80GW by 2030. This equates to 11.7% of the total estimated US power demand in 2030. The challenge is that newer facilities will be much larger in comparison, ranging from 300-500MW of capacity with some upwards of 1GW in capacity.

Constellation Energy Corporation (NASDAQ: CEG)

Constellation was spun off from Exelon Energy (NASDAQ: EXC) at the beginning of 2022 as an independent utility with the intent of focusing on clean energy power sources, including hydrogen, nuclear, and other renewable resources.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.