Company Coverage Updates:

Boss Energy (OTC: BQSSF)

Boss Energy Set For Profitability, With The Ramp Up Of Uranium Production

Diversified Energy Company (NYSE: DEC)

Diversified Energy's Next Growth Strategy Is Targeting The Data Center Power Market (Rating Upgrade)

Riot Platforms (NASDAQ: RIOT)

Riot Platforms' Diversification Plan May Face Immense Competition

ETF Coverage Updates:

ANGL May Be A Riskier Investment Than One Might Expect

VTEB Provides Diversification For Income Seekers

SH Can Provide Investors Inverse Risk To The Market

VPU: Utilities Have Much To Gain From The Growing AI Data Center Boom

BNDX Can Provide International Exposure For Those Seeking Non-U.S. Bonds

We will be making an addition to this newsletter in the coming months. Similar to the model portfolio, we will be reporting a short-list of ETFs investors can consider as part of their broader investment strategy.

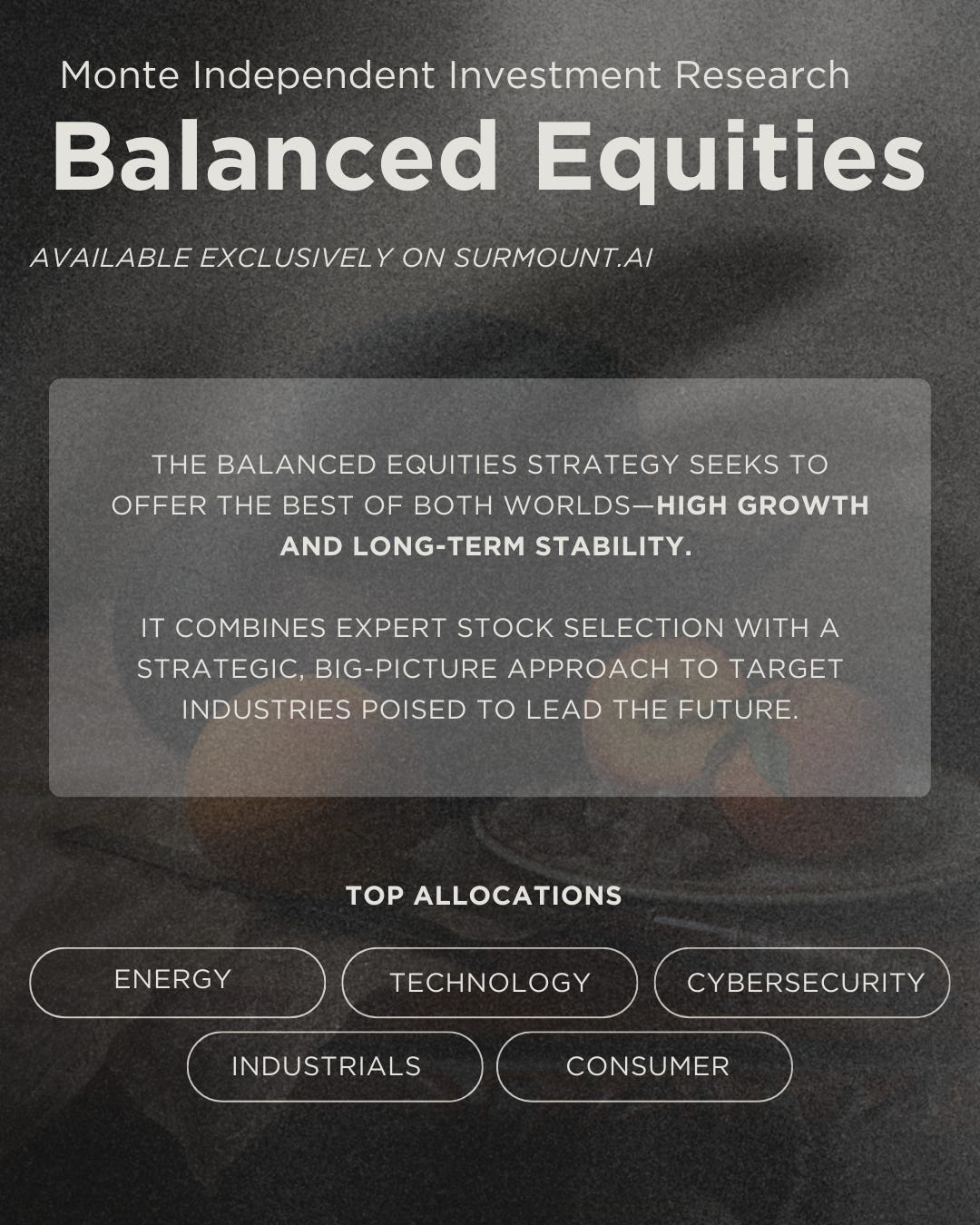

You can now invest with us through Quantbase in Monte - Balanced Equities Fund. This strategy employs the deep research found throughout this newsletter into a single, investable equity strategy.

Boss Energy (OTC: BQSSF)

Boss Energy Set For Profitability, With The Ramp Up Of Uranium Production

Boss Energy is an Australian-based uranium mining company. The organization has been developing the Honeymoon Project for the last few years, beginning production a year ago and delivering first uranium in 2025. In terms of market breadth, Boss Energy can service most regions, including China, for uranium demand, potentially mitigating risks to enrichment capacity when compared to its US peers given the heightened US/Russian trade sanctions.

With China further developing its nuclear capacity, offtake may be expanding as Boss Energy ramps up production capacity.

Trading this stock may be challenging for US-based investors as it is not traded on US exchanges, potentially adding substantial fees for those that may be trading smaller lots.

Diversified Energy Company (NYSE: DEC)

Diversified Energy's Next Growth Strategy Is Targeting The Data Center Power Market (Rating Upgrade)

I had initially reported on Diversified Energy Company at the end of 2023 with negative sentiment towards the company. DEC has been undergoing a substantial transformation through a series of asset acquisitions and a recently announced $2b partnership with The Carlyle Group to acquire and securitize assets.

Unlike the larger oil and natural gas producers, DEC acquires mature, producing properties, making DEC a relatively conservative investment strategy. DEC’s strategy is also differentiated with its securitization approach, selling asset-backed securities [ABSs] on its producing assets while de-risking production with a robust 5-year hedge book. In theory, DEC should be a relatively safe investment; however, the hedge book can create substantial volatility in the company’s earnings, particularly as a result of its primary producing assets being natural gas-oriented.

Riot Platforms (NASDAQ: RIOT)

Riot Platforms' Diversification Plan May Face Immense Competition

Riot Platforms is a bitcoin mining organization. Bitcoin mining has become a relatively challenging business following the halving event last year, crushing margins and making it harder to compete as an enterprise. The saving grace for the industry was the recent reporting rule change for digital asset reporting on the income statement, making or breaking profitability from quarter to quarter.

Riot is working to diversify its book of business outside of bitcoin mining as a data center designer. The organization has certain manufacturing capabilities for components for electrification, potentially acting as a catalyst for growth in the coming quarters, particularly as the US decouples from Chinese manufacturing.

Riot is also seeking to expand its capabilities as a data center host for high performance computing customers. I suspect that this may be a more challenging business to break into given the competition and purpose-built facilities being constructed by the likes of Oracle Corporation (ORCL).