Company Coverage Vol. XIII

CRWD; GSAT; ORCL; PULS; PFXF; DPG; BTAL; DFE; AIQ; HYBI; ETG; SPXS; FBY

Company Coverage Updates:

CrowdStrike (NASDAQ: CRWD):

CrowdStrike's Secret Weapon: How Charlotte AI Is Changing The Cybersecurity Game (Rating Downgrade)

Globalstar (NASDAQ: GSAT)

Globalstar Is Set For Launch; Growth May Already Be Priced In

Oracle Corporation (NYSE: ORCL)

Oracle's Multi-Cloud Strategy Shift Is Proving To Be A Success

ETF Updates:

PULS Can Provide Liquidity, But It May Be Time To Rotate Into Long-Dated Bonds

PFXF May Have Too Much Exposure To Boeing Preferred Shares

DPG May Realize Substantial Growth In The Coming Years, But May Not Be The Most Optimal Solution

BTAL Battles With Short, High-Beta Stocks

DFEN: Defending The U.S. Can Boost This Leveraged ETF

AIQ: Outperformance May Continue As AI Adoption Continues To Expand

HYBI: Say Goodbye To The High Fees And Buy The Underlying ETFs Instead

ETG's Value-Oriented Investment Approach Could Generate Substantial Growth For Your Portfolio

SPXS: The Leveraged ETF That Could Make Or Break Your Portfolio

FBY: Far From Being An Optimal Strategy For Holding META

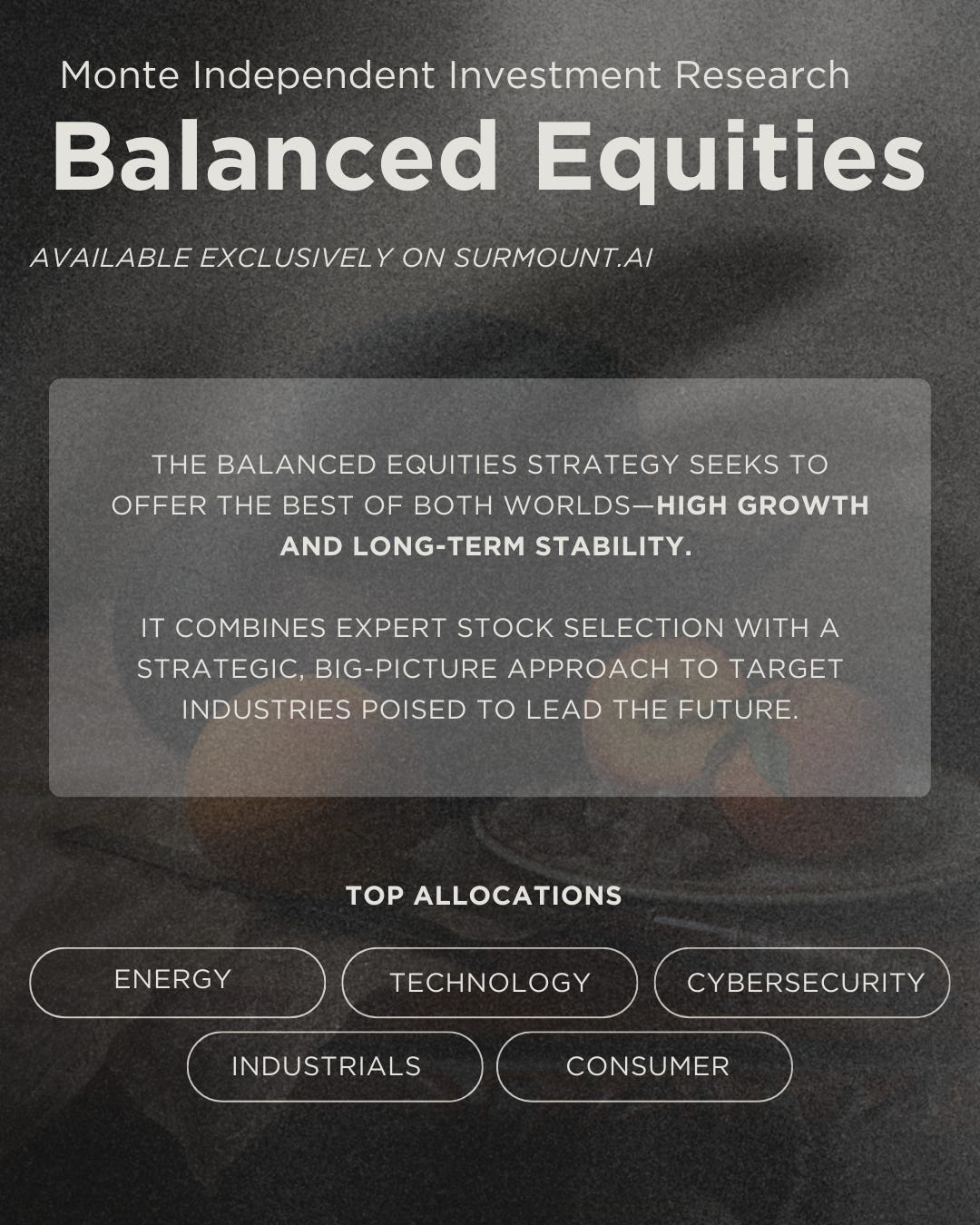

The aggregate Energy and Technology Indices continue to outperform the broader market with the 1-month performance beating the aggregate index by a wide, 2%+ margin. Industrials are likely to lag for another quarter or so as tariff-driven inflationary pressures circulate through the supply chain. Given that the vast majority of intermediates have enacted pricing mitigation to fend from margin compression, the likely result will be higher prices for the end-customers. Many of the names covered in this newsletter can be considered critical for the next generation facilities or are directly tied to AI data centers. Given that electrification is a need to have and not a want to have, we can expect a certain margin of safety in terms of volume purchases.

Be sure to catch up on my recent coverage of Hubbell Inc. (NYSE: HUBB).

CrowdStrike (NASDAQ: CRWD):

CrowdStrike's Secret Weapon: How Charlotte AI Is Changing The Cybersecurity Game (Rating Downgrade)

CrowdStrike has been a company under our coverage radar for quite some time. As the only single-platform solution covering on-prem, cloud, and hybrid cloud environment, CrowdStrike has an impactful moat above competitors such as Palo Alto Networks (PANW).

CrowdStrike continued to face certain financial hurdles following the July 2024 outage incident with the expectation of curtailment going through the duration of eFY26.

The biggest strength CrowdStrike brings to the table, net of being a unified security platform, is its embedded AI features, particularly for SecOps. The rationale behind this is that as more identities, particularly machine identities, enter into an enterprise environment, the greater the risk of a breach. With GenAI and agentic AI quickly ramping up, the risk of malicious agents entering the environment increases without the appropriate use of autonomous identity management software, as offered by companies like CRWD, ZS, and CYBR. The question is whether CrowdStrike’s unified platform can outbid the single-point solutions offered by ZS and CYBR.

Globalstar (NASDAQ: GSAT)

Globalstar Is Set For Launch; Growth May Already Be Priced In

Globalstar is in the process of replacing its MSS satellite constellation with the help of a single large operating customer. In addition to this, GSAT entered into the beginning stages of its XCOM RAN, 2-way satellite connectivity system and is expecting to ramp up its customer base in the coming quarters.

Thematically, GSAT fits into the communications side of the industrial automation & robotics strategy, providing satcom for orchestration. The two-way connectivity is the next phase in the program, allowing for customers to actively monitor and engage with their robotic fleets remotely. The ultimate question is whether satcom is the best strategy for autonomous operations, or whether a closed network will be just as effective and secure.

Oracle Corporation (NYSE: ORCL)

Oracle's Multi-Cloud Strategy Shift Is Proving To Be A Success

ORCL shares have more than rebounded following the rocky start to 2025. As we’ve historically reported, Oracle is quickly becoming a prominent contributor to the larger data center development initiative with a key positioning in the Project Stargate.

Oracle’s biggest differentiator when compared to peer hyperscalers is that Oracle’s AI applications will be primarily utilized with internal enterprise data, creating a closed-loop system for AI development for process optimization. With enterprises quickly adopting some form of GenAI and agentic AI, I suspect Oracle will greatly benefit from the technological transition.