Company Coverage Updates Vol. XII

NVDA, VOYG, LUNR, CLSK, NVDX, QLD, ARKX, PFIX, JPC, SCHO, PDT

Company Coverage Updates:

Nvidia Corporation (NASDAQ: NVDA)

Voyager Technologies (NYSE: VOYG)

Intuitive Machines (NASDAQ: LUNR)

CleanSpark (NASDAQ: CLSK)

ETF Research:

QLD Can Help Traders Amplify Their Returns On The Nasdaq-100

NVDX Can Be Your Leveraged Strategy For Trading Nvidia Shares

ARKX: The Space ETF That Could Be Your Portfolio's Golden Dome

PFIX: It May Be Time To Consider Hedging Against Inflation And Interest Rates

JPC's Leverage Strategy Could Supercharge Your Returns (Or Sink Them)

SCHO: The Case For Rotating Out Of Short-Duration Treasuries

Market Update

Year-to-date, the market has undergone a significant recover following the rocky start. Industrials, Materials, and Energy have substantially outperformed the broader index, including Technology. These markets are particularly reflected in the Monte Balanced Model Portfolio, now available on Quantbase.

Nvidia Corporation (NASDAQ: NVDA)

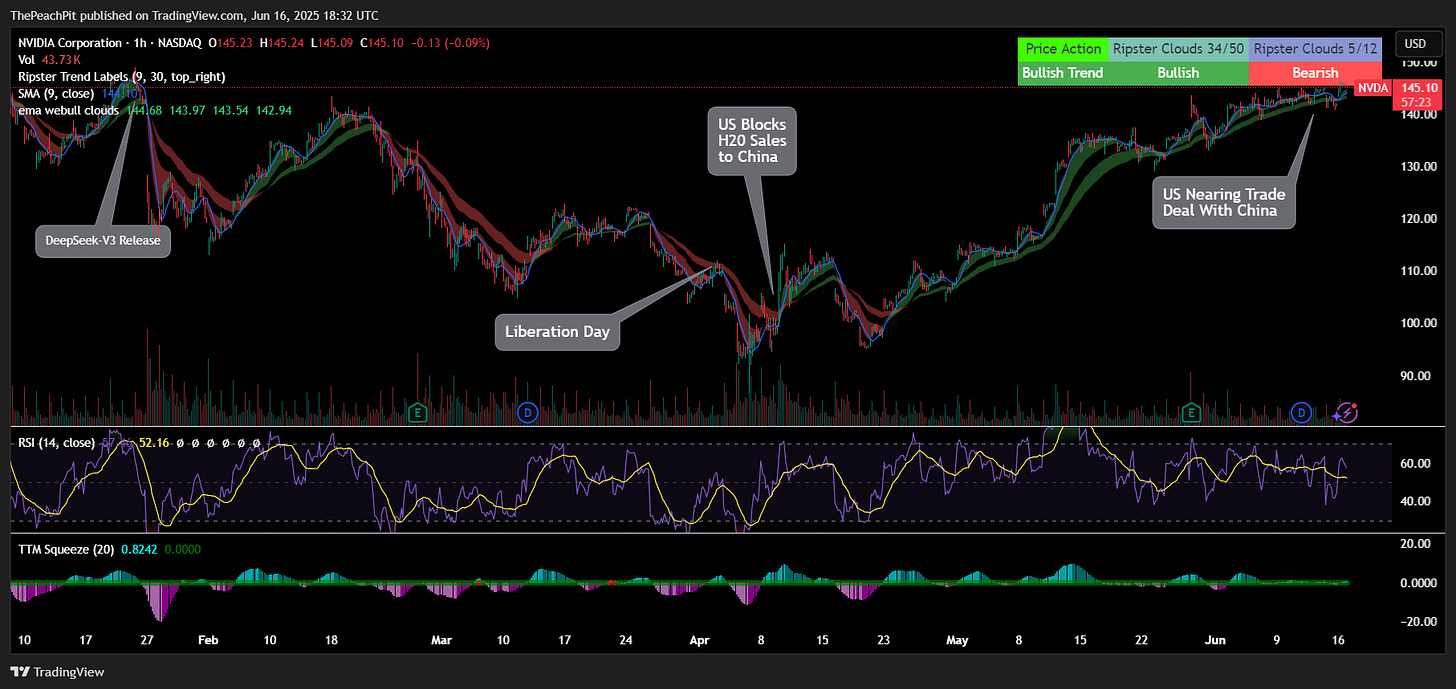

Nvidia Stands To Benefit From Positive U.S. And China Trade Talks

The overall thesis remains intact despite trade restrictions between the US & China, impacting revenue and margins in q1’26. Management is anticipating $8b in lost revenue for eq2’26 as a result of these trade restrictions despite trade talks between the two nations easing up.

I was asked in the comments about my financial forecast for Nvidia and how I can rationalize the stated figures in the report. The short answer is the flywheel effect: as cloud services providers [CSPs] build new data center capacity, Nvidia’s installed base will expand on top of its existing installed base. Given that GPUs need to be replaced every 1-2 years when running at full capacity in a CSP’s data center, we can safely expect a compounding effect from the growing compute capacity footprint.

Voyager Technologies (NYSE: VOYG)

Voyager's IPO Rocketed, But Here's Why Investors Should Brace For Impact

Voyager held its IPO last week with a splashy entrance to the public markets. Shares shot up over 80% in the first day of trading before settling in the days following.

Voyager is an interesting organization, participating in a variety of DoD contracts. In particular, Voyager is contracted with Lockheed Martin to develop hypersonic propulsion systems, a technology that has been developed in China, posing a potential risk to US national defense.

In addition to this, Voyager is in the development stage for the Starlab, the commercial replacement for the International Space Station. The Starlab is intended to be leased out to private organizations for pharmaceutical development, advanced chip fabrication, as well as other applications that may benefit from a zero-gravity environment.

Overall, Voyager has a large opportunity for growth in the coming years for DoD & space exploration.

Intuitive Machines (NASDAQ: LUNR)

Intuitive Machines Takes One Small Step For National Defense

Remaining on the space theme, we updated LUNR this week following the massive share price run-up following its robust q1’25 results. As a reminder, LUNR stock took a nasty dive following the faulty landing of its lunar rover at the beginning of the quarter. Despite the mishap, management has been taking action to improve the technology stack to ensure a successful second go-around. It baffles me that 1969 technology outperforms 2025 technology!

LUNR is also diversifying its book of business into DoD-related contracts, partnering with the US Air Force to develop a nuclear propulsion system for stealth satellites. Between LUNR and VOYG, we very well may be entering into the next generation of warfare.

CleanSpark (NASDAQ: CLSK)

CleanSpark's Bitcoin Mining Boom - 50 EH/s Target May Not Solve Profitability

CleanSpark remains one of the few pureplay bitcoin mining companies on the market. CleanSpark has been undergoing major advancements in its bitcoin mining capacity, nearing 50EH/s. Nonetheless, bitcoin mining quickly became less profitable following the most recent halving event and will only become a less profitable business model going forward. It’s no secret that bitcoin mining is a major user of electricity. With the model of balancing the grid of excess power production from intermittent power sources, the use case somewhat makes sense. With power demand quickly increasing with the ever-expanding data center footprint in support of AI development, I suspect electricity prices will only go up.

One of the biggest determinants is the manufacturing capacity between gas turbine giants GE Vernova (GEV) and Siemens (SMNEY), both of which have backlogs that are booked through 2028.