3M (NYSE: MMM): More Than Just Taping Operations Together

A few years ago, analysts were arguing over the type of recovery the economy will undergo post-C19. They argued over a “V” shaped recovery, a “K” shape, a “J” shape, amongst other letter-oriented anomalies. Early on in the recovery, the “J” shape was quite apparent as non-tech companies experienced a spurt of growth followed by a waning drive-down.

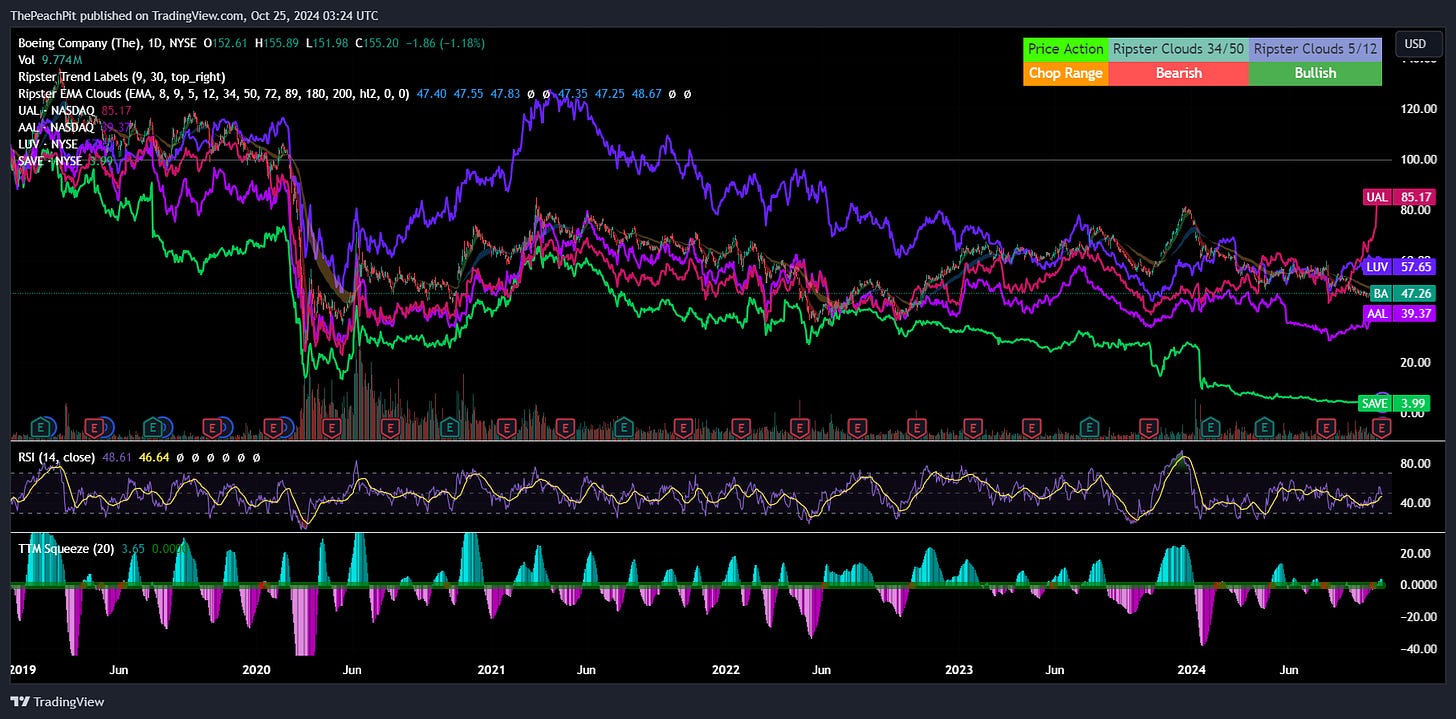

The conversation came up yesterday in my investor group that Boeing (BA) never quite recovered post-Covid. Though the plane maker’s woes were ongoing well before the pandemic, the company’s stock never quite returned to its pre-C19 levels. The same phenomenon has occurred across the airlines despite the consumer spending craze as it relates to pent-up demand for travel.

This quickly faded and reality set in. The industry never quite made up lost ground as discounts and volumes never quite recovered to its peak.

This week we’re moving back to the industrials sector with 3M (NYSE: MMM). 3M has been undergoing a major restructuring as the firm’s 1-quarter in CEO Bill Brown attempts to turn this massive ship around to growth. 3M is one of those firms that produces everyday items that most offices and households supply, and yet the name remains out of sight and out of mind.

Keep reading with a 7-day free trial

Subscribe to Monte Independent Investment Research to keep reading this post and get 7 days of free access to the full post archives.